After hitting their 52 week high on September 28, Walgreen Company (NYSE:WAG) shares slid 0.4% that day after announcing their fourth quarter results. The world’s largest drug store reported fourth quarter revenue of $17.07 billion, down 5% year-over-year. While revenues were in line with analysts’ expectations, adjusted earnings best estimates. Analysts expected fourth quarter net earnings to be $0.55 per share, and Walgreen reported $0.66 per share. On an annual basis, Walgreen’s revenues slid 0.8% to $71.63 billion, and their diluted EPS was $2.42, down from $2.94 in 2011. The impact from leaving the Express Scripts network impacted annual earnings by $0.21.

While Walgreen decreased their weighted average diluted shares outstanding from 924.5 million in 2011, to 880.1 million in 2012, diluted shares outstanding actually increased from 865.2 million in the third quarter of 2012, to 895.3 in the fourth quarter of 2012. The change in shares is primarily due to the impact of share repurchases which was partially offset by the impact of the 83.4 million shares issued due to the Alliance Boots acquisition.

Alliance Boots Acquisition

Looking at the Alliance Boots acquisition, executives at Walgreen’s believe that with combined retail stores and distribution touch points of more than 180,000 in 26 countries, they are well positioned to change the paradigm in the industry as the world’s largest and most innovative company in their space. The acquisition of Alliance Boots will help Walgreen accelerate their core strategies. These strategies include: creating an unmatched supply chain, having the largest retail pharmacy distribution network in the world, being the world’s largest purchaser of prescription drugs and many other health and well-being products, and having a platform for global expansion beyond the U.S. and Europe in new markets around the world.

Walgreen expects to realize $100 million to $150 million in combined synergies from the partnership in 2013, and more than $1 billion by 2016. Walgreen looks to get their money’s worth out of the acquisition in more than finding synergies, and they are already making a push to expand further internationally. Alliance Boots recently announced their intent to acquire a 12% stake in Nanjing Pharmaceutical Company, the fifth largest pharmaceutical wholesaler in China.

There are concerns about reimbursement rates coming down in Europe and affecting Alliance Boots’s margins. More governments are pushing for generics versus brands as a key button to save money. In Southern Europe, generic penetration is only 30%; in Northern Europe it’s at 50%. The European wholesale market is not as consolidated as it is in North America. There are various small players in the wholesale industry, and the tougher economies are making business difficult for them and making it even more difficult to get credit. This gives Alliance an opportunity to grab market share and continue to grow.

Express Scripts Client Retention

To understand how Walgreen views the process of retaining clients they lost from their temporary break-up with Express Scripts Holding Company (NASDAQ:ESRX), Wade Miquelon, CFO and executive vice president at Walgreen, broke the process in to three buckets. First are the loyal patients who will come back in the first couple of weeks, the second bucket are people who will need some convincing and Walgreen’s plans to market to, and the third bucket is customers who will be tough to get back and are believed to slowly return in the long-term. Walgreen did not give an specific numbers on returning customers, but there should be more available information about retention of Express Scripts customers by the next quarter.

Competition

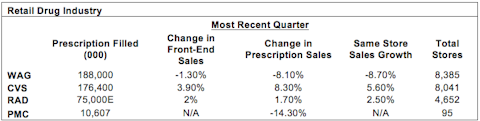

To get an idea of the competitive landscape in the retail drug industry, a comparison of Walgreen, CVS Caremark Corporation (NSYE:CVS), Rite Aid Corporation (NYSE:RAD), and PharMerica Corporation (NYSE:PMC) should shed some light.

Despite customers in the Express Scripts network moving to a new pharmacy at some point this year, Walgreen still leads the industry in prescriptions filled (excluding those from Alliance Boots). CVS and Rite Aid were the main beneficiaries from the WAG/ESRX dispute. Even with the downward pressure on sales from generic introductions, CVS managed to grow prescription sales at 8.30%, while Rite Aid grew prescription sales at 1.70%. Rite Aid doesn’t disclose the amount of prescriptions they fill on a quarterly basis, so to get the 75,000 figure, I divided their 2012 annual prescriptions filled of 250 million by four (quarters), and then multiplied that by the 2% growth rate they have grown prescription sales at. PharMerica is a small-cap institutional pharmacy, and therefore, they did not benefit from increased prescription sales from the WAG/ESRX dispute.

Moving Forward

After a challenging 2012, Walgreen should have a smoother 2013 stemming from regaining lost Express Scripts customers and synergies from Alliance Boots. The largest drugstore in the world has diversified their business by branching out into the wholesale arena, while making a push to become a health and daily living store. Walgreen shares continue to gain traction, as investors feel more confident in the company’s prospects. Walgreen has increased dividends for 37 consecutive years and are an attractive investment for value investors looking for a defensive company that has national and international growth potential.

In the hedge fund industry, some prominent names holding Walgreen in their portfolios include D.E. Shaw, Michael Messner, Ray Dalio, Cliff Asness, and Charles de Vaulx. For a complete look at hedge funds’ sentiment towards this stock, continue reading here.

Disclosure: Mike is long Walgreen Company.