You have to have a very strong personality to ignore lower prices, and terrible looking fundamentals, because you understand the nature of the cyclical energy business. If you have analyzed the past, you would notice that the current downturn is nothing new under the sun. Studying the past should provide you with the perspective not to bail out when the going gets tough. At the bottom of the cycle, you will get all types of “stories” that are meant to scare you, which project the recent weaknesses onto the future indefinitely. In the current downturn environment, we are hearing about major oil producing countries which are facing financial difficulties, because they didn’t plan ahead. It is to be expected that countries, just like people, do not like to save during the boom times, in order to remain solvent during the downturns. The new stories we are hearing today however is that this downturn will never end, because somehow the world will embrace green energy, and we would all be singing kumbaya by the end of the decade.

I do not think that the world will stop using oil and natural gas right away. There are so many uses of these commodities, and we have so many entrenched economic activities around those commodities, that it would take several decades for ALL the countries in the world to reach a decision and act on it to replace oil & gas with green energy. Of course, as I mentioned above, commodities like oil are used in a lot of other activities, besides energy.

These stories ignore the facts that managements with great capital allocation skills can still provide value to shareholders, even if the price of the commodity is low and stays low for two decades. These managements can buy back shares if they are selling at attractive prices. They could also acquire other companies or merge with larger competitors, in an effort to reduce their costs.

It pays to own a diversified integrated company like Exxon Mobil Corporation (NYSE:XOM) or Chevron Corporation (NYSE:CVX). The E&P business is cyclical. The R&M business is cyclical as well. However, they usually run on different cycles, which offset each other to a certain extent. In the current downturn, R&M is doing fine. E&P only companies are the ones cutting dividends when things are tough, as evidenced by the recent moves with the likes of ConocoPhillips in early 2016.

The 1980s and 1990s were a miserable time for commodity companies. Despite all of those headwinds however, investors who followed a disciplined investment plan through thick and thin, managed to do pretty well for themselves.

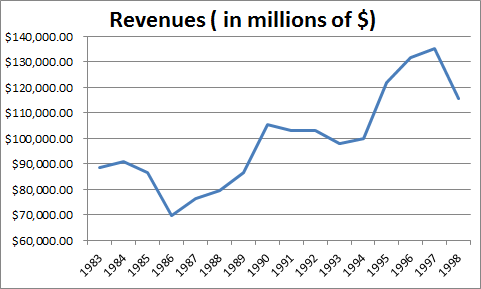

For example, I studied at the trends in revenues, net income, earnings per share and dividends per share for Exxon between 1983 and 1998. You may find that net income and revenues didn’t increase much for over 15 years in a row. Even then, Exxon was known for its conservative fortress like balance sheet. It deserved a premium for the fact that it was a quality company, which was extremely well run.

For example, revenues for Exxon increased from $88.5 billion in 1983 to $115.4 billion in 1998.

Exxon’s net income increased all the way from $4.978 billion in 1983 to $6.44 billion fifteen years later, despite the low energy prices. The impact of weak commodity prices was partially offset by the decrease in corporate tax rates. Another helpful factor was the decrease in interest rates during the period, which reduced the cost to borrow.