But it now appears that the writing is on the wall and any significant slowdown in China will have a significant effect on the Australian economy. Economic data from China already indicates that the country’s economic growth will continue to slow causing the demand for commodities to slide. I believe this indicates that now is the time for investors to reconsider being exposed to the Australian economy.

For U.S. investors this would include investments in the two Australian companies listed on the NYSE, Westpac Banking Corp (ADR) (NYSE:WBK) and BHP Billiton Limited (ADR) (NYSE:BHP). It would also affect investors in those companies that have considerable exposure to Australian, such as Rio Tinto plc (ADR) (NYSE:RIO).

There are already signs that international investors are heading for the exits, with the Australian dollar for the year to date plunging 7% against the U.S. dollar to 96.5 cents. This drop in value will already have seen many international investors who acquired Australian assets when the Australian dollar was at its peak, incur paper losses on the value of those investments. But the big question remains–should they exit those investments and crystallize those losses or ride out the impending storm?

Economic background

The Australian economy’s dependence on China becomes clear when it is considered that it is an export oriented economy, with the top three exports being iron ore, coal and gold. China is also the country’s largest export market, as the chart below illustrates, accounting for almost 25% of all exports in 2011.

Source: Australian Government Department of Foreign Affairs and Trade.

This underscores the Australian economy’s reliance upon China and the demand for iron ore and coal to generate economic growth.

Macro-economic indicators

China´s economic continues to decline with recent data, suggesting it will continue to slow. It is forecast that the country´s GDP will expand by 7.8% in 2013, which is a 10 bps decrease from the 7.9% growth seen in 2012. Recent economic data indicates that the economy is continuing to slow. The April 2013 Chinese manufacturing PMI declined by 30bps month on month to 50.6%, as the chart below shows.

Source: National Bureau of Statistics of China.

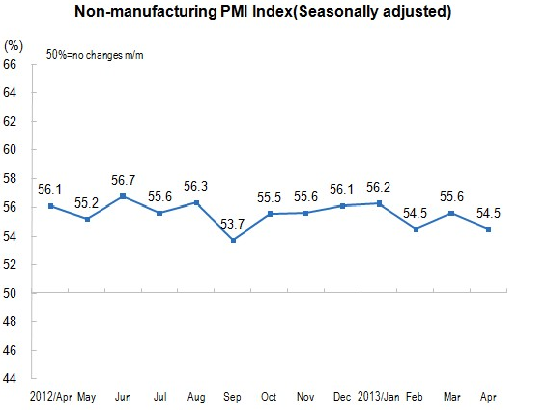

The non-manufacturing PMI also declined dropping by 90bps month on month to 54.5%, as shown by the chart below.

Source: National Bureau of Statistics of China.

Both indicate that while the economy is continuing to grow, this growth is negligible, with both PMIs only being just above the critical (growth) 50% threshold.

Furthermore, for 2014 it is expected that China’s GDP growth will be slightly higher than 2013 at 8%, but this is still well off the almost double digit rates experienced in 2010 and 2011. All of which certainly doesn’t bode well for companies and countries dependent upon China’s economic growth, industrial activity and consumption of commodities.

Company outlook

BHP Billiton Limited (ADR) (NYSE:BHP), the world’s largest mining company, has seen its share price fall by almost 17% for the year to date on the back of flat sales and declining net income, which fell by 23% half on half. Even more worrying is that company’s debt ballooned by almost 30% half on half to almost $36 million. This has resulted in BHP Billiton Limited (ADR) (NYSE:BHP) repositioning many of its operations and engaging in significant cost cutting exercises.

Based on the company’s first half 2013 financial performance, combined with the negative outlook for China, I don’t expect BHP to be reporting stellar results for some time yet. I would expect to see its share price continue to fall over the short term, until the cost control initiatives have gained traction.

Rio Tinto plc (ADR) (NYSE:RIO) is fairing even more poorly than BHP Billiton Limited (ADR) (NYSE:BHP)–for the year to date its share price is down by 27%, and for the first half of 2013 its revenue fell by 19% to $16 billion. However, even more worrying was that net income plunged into the red, falling more than twofold to -$5.6 billion. But this significant decline occurred because Rio wrote down the value of many of its poorly performing assets on the expectation that demand from China will continue to fall. I don’t expect to see any significant recovery in its share price and I believe that revenue will remain flat.

Westpac Banking Corp (ADR) (NYSE:WBK), Australia’s largest home mortgage lender and Australia’s second largest bank by assets and a favorite with U.S. dividend investors with its dividend yield of 6.5%, has been delivering stellar results. For the first half 2013 revenue remained flat, but net income grew by almost 11% half on half to $1.6 billion. The bank has also been able to grow its market share, but like most of Australia’s top four bank’s it is dangerously addicted to debt as a means of financing its lending operations. At the end of the first half it had a debt to equity ratio of over 3, making it particularly vulnerable to negative movements in international credit markets and an economic slowdown in Australia.

In fact it is expected that as Australia’s economy slows loan defaults and the cost of credit will rise, while domestic consumption and the demand for credit will fall. As a result I expect Westpac Banking Corp (ADR) (NYSE:WBK)’s revenue and profitability to decline, as it will not be able to reduce interest costs because of its over-reliance on debt. This will see the bank’s share price decline, and in a worst case scenario possibly even a dividend cut.

Bottom line

It is clear that the economic outlook for Australia is less than optimistic with China’s economic data indicating that its economy will continue to slow. This will have a significant impact on the Australian economy and those companies in Australia that are reliant on commodities demand or the domestic economy for growth. All of which makes me believe that it is time to avoid those companies.

The article Investors Should Be Wary of Exposure to Australia originally appeared on Fool.com and is written by Matt Smith.

Matt Smith has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Matt is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.