But it now appears that the writing is on the wall and any significant slowdown in China will have a significant effect on the Australian economy. Economic data from China already indicates that the country’s economic growth will continue to slow causing the demand for commodities to slide. I believe this indicates that now is the time for investors to reconsider being exposed to the Australian economy.

For U.S. investors this would include investments in the two Australian companies listed on the NYSE, Westpac Banking Corp (ADR) (NYSE:WBK) and BHP Billiton Limited (ADR) (NYSE:BHP). It would also affect investors in those companies that have considerable exposure to Australian, such as Rio Tinto plc (ADR) (NYSE:RIO).

There are already signs that international investors are heading for the exits, with the Australian dollar for the year to date plunging 7% against the U.S. dollar to 96.5 cents. This drop in value will already have seen many international investors who acquired Australian assets when the Australian dollar was at its peak, incur paper losses on the value of those investments. But the big question remains–should they exit those investments and crystallize those losses or ride out the impending storm?

Economic background

The Australian economy’s dependence on China becomes clear when it is considered that it is an export oriented economy, with the top three exports being iron ore, coal and gold. China is also the country’s largest export market, as the chart below illustrates, accounting for almost 25% of all exports in 2011.

Source: Australian Government Department of Foreign Affairs and Trade.

This underscores the Australian economy’s reliance upon China and the demand for iron ore and coal to generate economic growth.

Macro-economic indicators

China´s economic continues to decline with recent data, suggesting it will continue to slow. It is forecast that the country´s GDP will expand by 7.8% in 2013, which is a 10 bps decrease from the 7.9% growth seen in 2012. Recent economic data indicates that the economy is continuing to slow. The April 2013 Chinese manufacturing PMI declined by 30bps month on month to 50.6%, as the chart below shows.

Source: National Bureau of Statistics of China.

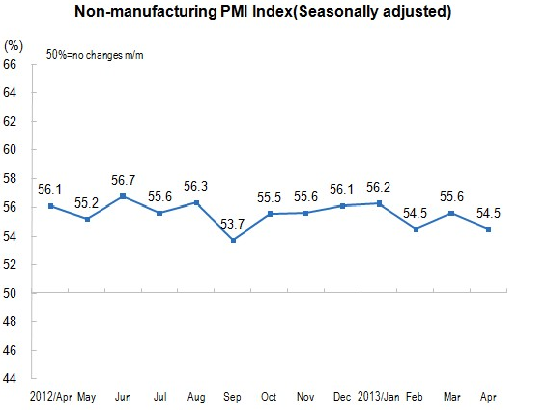

The non-manufacturing PMI also declined dropping by 90bps month on month to 54.5%, as shown by the chart below.

Source: National Bureau of Statistics of China.

Both indicate that while the economy is continuing to grow, this growth is negligible, with both PMIs only being just above the critical (growth) 50% threshold.

Furthermore, for 2014 it is expected that China’s GDP growth will be slightly higher than 2013 at 8%, but this is still well off the almost double digit rates experienced in 2010 and 2011. All of which certainly doesn’t bode well for companies and countries dependent upon China’s economic growth, industrial activity and consumption of commodities.