In this article we are going to use hedge fund sentiment as a tool and determine whether Alibaba Group Holding Limited (NYSE:BABA) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

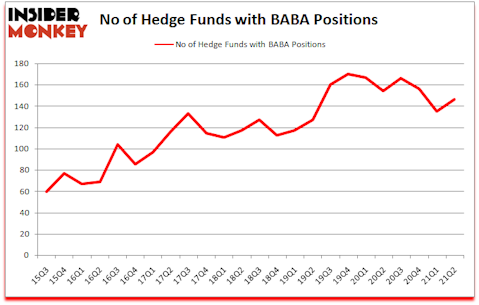

Is Alibaba Group Holding Limited (NYSE:BABA) the right investment to pursue these days? Money managers were becoming hopeful. The number of long hedge fund bets moved up by 11 recently. Alibaba Group Holding Limited (NYSE:BABA) was in 146 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 170. Our calculations also showed that BABA ranked 8th among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 135 hedge funds in our database with BABA positions at the end of the first quarter.

Today there are several signals investors have at their disposal to appraise publicly traded companies. A duo of the less known signals are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the elite investment managers can beat the broader indices by a superb amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Chase Coleman of Tiger Global

Now let’s check out the key hedge fund action regarding Alibaba Group Holding Limited (NYSE:BABA).

Do Hedge Funds Think BABA Is A Good Stock To Buy Now?

At Q2’s end, a total of 146 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from one quarter earlier. By comparison, 154 hedge funds held shares or bullish call options in BABA a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Fisher Asset Management was the largest shareholder of Alibaba Group Holding Limited (NYSE:BABA), with a stake worth $3204.3 million reported as of the end of June. Trailing Fisher Asset Management was Citadel Investment Group, which amassed a stake valued at $2091.8 million. Millennium Management, Rokos Capital Management, and Tiger Global Management LLC were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Polunin Capital allocated the biggest weight to Alibaba Group Holding Limited (NYSE:BABA), around 34.61% of its 13F portfolio. Mohnish Pabrai is also relatively very bullish on the stock, dishing out 21.13 percent of its 13F equity portfolio to BABA.

Consequently, key hedge funds have been driving this bullishness. GQG Partners, managed by Rajiv Jain, assembled the most outsized position in Alibaba Group Holding Limited (NYSE:BABA). GQG Partners had $753.2 million invested in the company at the end of the quarter. Douglas Harold Hart Polunin’s Polunin Capital also initiated a $112.1 million position during the quarter. The other funds with brand new BABA positions are Chris Rokos’s Rokos Capital Management, Simon Sadler’s Segantii Capital, and Marcio Appel’s Adam Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Alibaba Group Holding Limited (NYSE:BABA) but similarly valued. We will take a look at Visa Inc (NYSE:V), NVIDIA Corporation (NASDAQ:NVDA), JPMorgan Chase & Co. (NYSE:JPM), Johnson & Johnson (NYSE:JNJ), Walmart Inc. (NYSE:WMT), UnitedHealth Group Inc. (NYSE:UNH), and Mastercard Incorporated (NYSE:MA). All of these stocks’ market caps are closest to BABA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| V | 162 | 27609638 | -2 |

| NVDA | 86 | 9098047 | 6 |

| JPM | 108 | 4928203 | -3 |

| JNJ | 88 | 7057087 | 7 |

| WMT | 71 | 8048192 | 13 |

| UNH | 105 | 13124871 | 16 |

| MA | 156 | 17098818 | 5 |

| Average | 110.9 | 12423551 | 6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 110.9 hedge funds with bullish positions and the average amount invested in these stocks was $12424 million. That figure was $16794 million in BABA’s case. Visa Inc (NYSE:V) is the most popular stock in this table. On the other hand Walmart Inc. (NYSE:WMT) is the least popular one with only 71 bullish hedge fund positions. Alibaba Group Holding Limited (NYSE:BABA) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for BABA is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 26.3% in 2021 through October 29th and beat the market again by 2.3 percentage points. Unfortunately BABA wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on BABA were disappointed as the stock returned -27.3% since the end of June (through 10/29) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Alibaba Group Holding Limited (NYSE:BABA)

Follow Alibaba Group Holding Limited (NYSE:BABA)

Receive real-time insider trading and news alerts

Suggested Articles:

- Bill Gates’ Stock Portfolio: Top 15 Picks

- 10 Best Data Center Stocks To Buy Now

- 10 Best Dividend Stocks to Buy Under $20

Disclosure: None. This article was originally published at Insider Monkey.