We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Synopsys, Inc. (NASDAQ:SNPS).

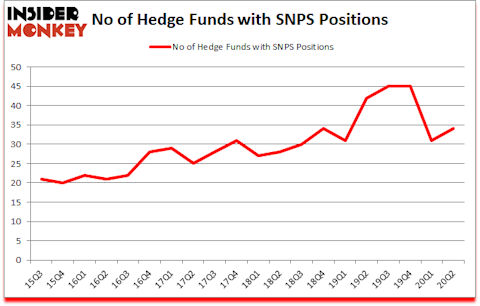

Synopsys, Inc. (NASDAQ:SNPS) was in 34 hedge funds’ portfolios at the end of June. The all time high for this statistics is 45. SNPS investors should be aware of an increase in enthusiasm from smart money in recent months. There were 31 hedge funds in our database with SNPS holdings at the end of March. Our calculations also showed that SNPS isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are a multitude of metrics shareholders have at their disposal to size up stocks. A couple of the best metrics are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the best investment managers can trounce their index-focused peers by a very impressive margin (see the details here).

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Last week, most investors overlooked a major development because of the presidential elections: Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 best high dividend stocks to buy to identify high dividend stocks with upside potential in this low interest rate environment. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Now we’re going to take a gander at the key hedge fund action regarding Synopsys, Inc. (NASDAQ:SNPS).

What have hedge funds been doing with Synopsys, Inc. (NASDAQ:SNPS)?

At the end of June, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 10% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SNPS over the last 20 quarters. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

More specifically, Alkeon Capital Management was the largest shareholder of Synopsys, Inc. (NASDAQ:SNPS), with a stake worth $465 million reported as of the end of June. Trailing Alkeon Capital Management was AQR Capital Management, which amassed a stake valued at $75.9 million. Newbrook Capital Advisors, Polar Capital, and Hitchwood Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Crestwood Capital Management allocated the biggest weight to Synopsys, Inc. (NASDAQ:SNPS), around 7.16% of its 13F portfolio. Newbrook Capital Advisors is also relatively very bullish on the stock, dishing out 5.14 percent of its 13F equity portfolio to SNPS.

As one would reasonably expect, key hedge funds have been driving this bullishness. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, assembled the biggest position in Synopsys, Inc. (NASDAQ:SNPS). LMR Partners had $14.6 million invested in the company at the end of the quarter. Zach Schreiber’s Point State Capital also initiated a $8.2 million position during the quarter. The other funds with brand new SNPS positions are Joel Greenblatt’s Gotham Asset Management, Lee Ainslie’s Maverick Capital, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Synopsys, Inc. (NASDAQ:SNPS) but similarly valued. These stocks are Brown-Forman Corporation (NYSE:BF), Chipotle Mexican Grill, Inc. (NYSE:CMG), The Travelers Companies Inc (NYSE:TRV), ZTO Express (Cayman) Inc. (NYSE:ZTO), Eversource Energy (NYSE:ES), Capital One Financial Corp. (NYSE:COF), and Amphenol Corporation (NYSE:APH). This group of stocks’ market values are closest to SNPS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BF | 28 | 521945 | 0 |

| CMG | 41 | 3780591 | -7 |

| TRV | 28 | 398629 | -1 |

| ZTO | 18 | 715518 | 3 |

| ES | 28 | 501377 | 2 |

| COF | 55 | 1908354 | 5 |

| APH | 42 | 1013347 | 0 |

| Average | 34.3 | 1262823 | 0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.3 hedge funds with bullish positions and the average amount invested in these stocks was $1263 million. That figure was $931 million in SNPS’s case. Capital One Financial Corp. (NYSE:COF) is the most popular stock in this table. On the other hand ZTO Express (Cayman) Inc. (NYSE:ZTO) is the least popular one with only 18 bullish hedge fund positions. Synopsys, Inc. (NASDAQ:SNPS) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for SNPS is 52.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. A small number of hedge funds were also right about betting on SNPS as the stock returned 9.7% since the end of the second quarter (through 10/30) and outperformed the market by an even larger margin.

Follow Synopsys Inc (NASDAQ:SNPS)

Follow Synopsys Inc (NASDAQ:SNPS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.