Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 823 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Marathon Petroleum Corp (NYSE:MPC) in this article.

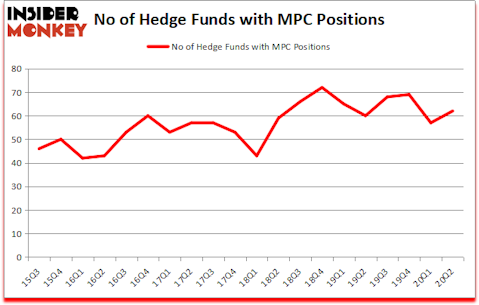

Is Marathon Petroleum Corp (NYSE:MPC) a buy, sell, or hold? Prominent investors were getting more optimistic. The number of bullish hedge fund positions improved by 5 in recent months. Marathon Petroleum Corp (NYSE:MPC) was in 62 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 72. Our calculations also showed that MPC isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 56 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 34% through August 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Paul Singer of Elliott Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Now we’re going to check out the key hedge fund action encompassing Marathon Petroleum Corp (NYSE:MPC).

How are hedge funds trading Marathon Petroleum Corp (NYSE:MPC)?

At the end of June, a total of 62 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 9% from the previous quarter. The graph below displays the number of hedge funds with bullish position in MPC over the last 20 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Elliott Investment Management, managed by Paul Singer, holds the biggest position in Marathon Petroleum Corp (NYSE:MPC). Elliott Investment Management has a $361.5 million position in the stock, comprising 3.9% of its 13F portfolio. Sitting at the No. 2 spot is Iridian Asset Management, managed by David Cohen and Harold Levy, which holds a $157.8 million position; 3.5% of its 13F portfolio is allocated to the company. Remaining peers with similar optimism include Paul Singer’s Elliott Investment Management, Andy Redleaf’s Whitebox Advisors and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Knighthead Capital allocated the biggest weight to Marathon Petroleum Corp (NYSE:MPC), around 9.99% of its 13F portfolio. Whitebox Advisors is also relatively very bullish on the stock, designating 6.81 percent of its 13F equity portfolio to MPC.

With a general bullishness amongst the heavyweights, some big names have jumped into Marathon Petroleum Corp (NYSE:MPC) headfirst. Knighthead Capital, managed by Tom Wagner and Ara Cohen, assembled the most outsized position in Marathon Petroleum Corp (NYSE:MPC). Knighthead Capital had $54.2 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $27.7 million position during the quarter. The other funds with brand new MPC positions are Jeffrey Altman’s Owl Creek Asset Management, Matt Sirovich and Jeremy Mindich’s Scopia Capital, and John Petry’s Sessa Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Marathon Petroleum Corp (NYSE:MPC). These stocks are Ford Motor Company (NYSE:F), Prudential Financial Inc (NYSE:PRU), Consolidated Edison, Inc. (NYSE:ED), Valero Energy Corporation (NYSE:VLO), Xilinx, Inc. (NASDAQ:XLNX), TransDigm Group Incorporated (NYSE:TDG), and McCormick & Company, Incorporated (NYSE:MKC). This group of stocks’ market valuations match MPC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| F | 30 | 791591 | -3 |

| PRU | 26 | 437049 | -2 |

| ED | 31 | 714139 | 6 |

| VLO | 39 | 157343 | -6 |

| XLNX | 47 | 1054542 | 9 |

| TDG | 62 | 6065530 | 4 |

| MKC | 32 | 251773 | 1 |

| Average | 38.1 | 1353138 | 1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.1 hedge funds with bullish positions and the average amount invested in these stocks was $1353 million. That figure was $1445 million in MPC’s case. TransDigm Group Incorporated (NYSE:TDG) is the most popular stock in this table. On the other hand Prudential Financial Inc (NYSE:PRU) is the least popular one with only 26 bullish hedge fund positions. Marathon Petroleum Corp (NYSE:MPC) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for MPC is 85.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 29.2% in 2020 through October 16th and beat the market by 19.7 percentage points. Unfortunately MPC wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on MPC were disappointed as the stock returned -20.2% since the end of June (through 10/16) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Marathon Petroleum Corp (NYSE:MPC)

Follow Marathon Petroleum Corp (NYSE:MPC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.