The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on December 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Genpact Limited (NYSE:G) based on those filings.

Genpact Limited (NYSE:G) has seen an increase in enthusiasm from smart money in recent months. Our calculations also showed that G isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most market participants, hedge funds are viewed as underperforming, old financial tools of yesteryear. While there are greater than 8000 funds trading today, We hone in on the top tier of this group, about 750 funds. These hedge fund managers administer most of the smart money’s total capital, and by tracking their finest stock picks, Insider Monkey has brought to light a few investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s check out the key hedge fund action surrounding Genpact Limited (NYSE:G).

What does the smart money think about Genpact Limited (NYSE:G)?

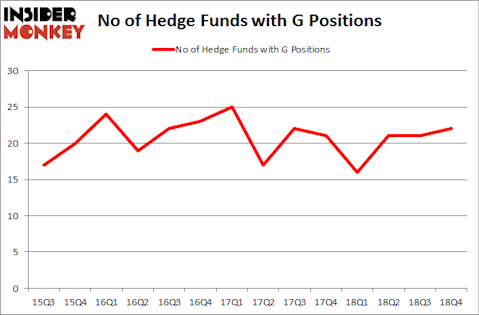

At Q4’s end, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in G over the last 14 quarters. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, D. E. Shaw’s D E Shaw has the biggest position in Genpact Limited (NYSE:G), worth close to $93.3 million, amounting to 0.1% of its total 13F portfolio. The second largest stake is held by Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $80.6 million position; 0.2% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions comprise Richard S. Pzena’s Pzena Investment Management, James Parsons’s Junto Capital Management and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Consequently, specific money managers were breaking ground themselves. Junto Capital Management, managed by James Parsons, assembled the biggest position in Genpact Limited (NYSE:G). Junto Capital Management had $42.7 million invested in the company at the end of the quarter. Greg Poole’s Echo Street Capital Management also initiated a $8.6 million position during the quarter. The other funds with new positions in the stock are Minhua Zhang’s Weld Capital Management, Ernest Chow and Jonathan Howe’s Sensato Capital Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Genpact Limited (NYSE:G) but similarly valued. We will take a look at StoneCo Ltd. (NASDAQ:STNE), Equitrans Midstream Corporation (NYSE:ETRN), Lincoln Electric Holdings, Inc. (NASDAQ:LECO), and Elastic N.V. (NYSE:ESTC). This group of stocks’ market valuations match G’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STNE | 20 | 755177 | 20 |

| ETRN | 28 | 966738 | 28 |

| LECO | 19 | 282772 | 0 |

| ESTC | 21 | 151738 | 21 |

| Average | 22 | 539106 | 17.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $539 million. That figure was $429 million in G’s case. Equitrans Midstream Corporation (NYSE:ETRN) is the most popular stock in this table. On the other hand Lincoln Electric Holdings, Inc. (NASDAQ:LECO) is the least popular one with only 19 bullish hedge fund positions. Genpact Limited (NYSE:G) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on Genpact as the stock returned 32.2% and outperformed the market as well. You can see the entire list of these shrewd hedge funds here.

Disclosure: None. This article was originally published at Insider Monkey.