Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 835 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider Tesla Inc. (NASDAQ:TSLA) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

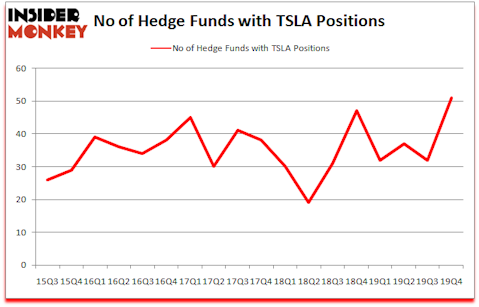

Tesla Inc. (NASDAQ:TSLA) investors should be aware of an increase in activity from the world’s largest hedge funds recently. Our calculations also showed that TSLA isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Matthew Hulsizer of PEAK6 Capital

Keeping this in mind we’re going to take a look at the latest hedge fund action regarding Tesla Inc. (NASDAQ:TSLA).

How are hedge funds trading Tesla Inc. (NASDAQ:TSLA)?

At Q4’s end, a total of 51 of the hedge funds tracked by Insider Monkey were long this stock, a change of 59% from the previous quarter. By comparison, 47 hedge funds held shares or bullish call options in TSLA a year ago. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in Tesla Inc. (NASDAQ:TSLA), which was worth $1953.8 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $1647.4 million worth of shares. D E Shaw, PEAK6 Capital Management, and Zevenbergen Capital Investments were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Tao Capital allocated the biggest weight to Tesla Inc. (NASDAQ:TSLA), around 21.03% of its 13F portfolio. Ariose Capital is also relatively very bullish on the stock, dishing out 14.09 percent of its 13F equity portfolio to TSLA.

As aggregate interest increased, specific money managers were breaking ground themselves. D E Shaw, managed by D. E. Shaw, established the biggest position in Tesla Inc. (NASDAQ:TSLA). D E Shaw had $500.7 million invested in the company at the end of the quarter. Alex Sacerdote’s Whale Rock Capital Management also initiated a $137.6 million position during the quarter. The following funds were also among the new TSLA investors: John Hurley’s Cavalry Asset Management, Nicholas J. Pritzker’s Tao Capital, and James Crichton’s Hitchwood Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Tesla Inc. (NASDAQ:TSLA) but similarly valued. We will take a look at CNOOC Limited (NYSE:CEO), The Estee Lauder Companies Inc (NYSE:EL), Automatic Data Processing, Inc. (NASDAQ:ADP), and Becton, Dickinson and Company (NYSE:BDX). This group of stocks’ market valuations are similar to TSLA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CEO | 14 | 235359 | -1 |

| EL | 50 | 1697103 | 2 |

| ADP | 51 | 2821795 | -5 |

| BDX | 50 | 1447307 | -1 |

| Average | 41.25 | 1550391 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41.25 hedge funds with bullish positions and the average amount invested in these stocks was $1550 million. That figure was $3044 million in TSLA’s case. Automatic Data Processing, Inc. (NASDAQ:ADP) is the most popular stock in this table. On the other hand CNOOC Limited (NYSE:CEO) is the least popular one with only 14 bullish hedge fund positions. Tesla Inc. (NASDAQ:TSLA) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but still beat the market by 12.9 percentage points. Hedge funds were also right about betting on TSLA as the stock returned 67.6% in 2020 (through May 1st) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.