Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 835 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider Yum! Brands, Inc. (NYSE:YUM) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

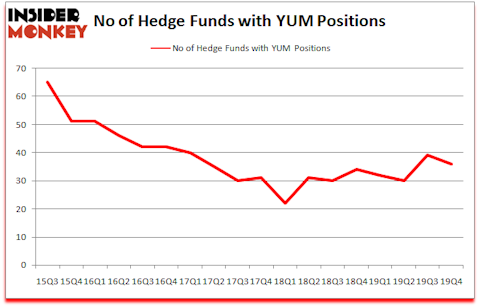

Yum! Brands, Inc. (NYSE:YUM) has seen a decrease in hedge fund sentiment lately. Our calculations also showed that YUM isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

John Overdeck of Two Sigma Advisors

We leave no stone unturned when looking for the next great investment idea. For example, COVID-19 pandemic is still the main driver of stock prices. So we are checking out this trader’s corona catalyst trades. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to check out the new hedge fund action surrounding Yum! Brands, Inc. (NYSE:YUM).

How have hedgies been trading Yum! Brands, Inc. (NYSE:YUM)?

Heading into the first quarter of 2020, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -8% from one quarter earlier. On the other hand, there were a total of 34 hedge funds with a bullish position in YUM a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, D E Shaw was the largest shareholder of Yum! Brands, Inc. (NYSE:YUM), with a stake worth $78.1 million reported as of the end of September. Trailing D E Shaw was Two Sigma Advisors, which amassed a stake valued at $71.5 million. Alkeon Capital Management, Citadel Investment Group, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position White Elm Capital allocated the biggest weight to Yum! Brands, Inc. (NYSE:YUM), around 0.96% of its 13F portfolio. Cognios Capital is also relatively very bullish on the stock, setting aside 0.78 percent of its 13F equity portfolio to YUM.

Judging by the fact that Yum! Brands, Inc. (NYSE:YUM) has faced bearish sentiment from the smart money, we can see that there is a sect of fund managers that slashed their positions entirely last quarter. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP cut the largest stake of the 750 funds followed by Insider Monkey, comprising close to $61.4 million in stock. Renaissance Technologies, also said goodbye to its stock, about $29.5 million worth. These bearish behaviors are important to note, as total hedge fund interest dropped by 3 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Yum! Brands, Inc. (NYSE:YUM) but similarly valued. These stocks are Paychex, Inc. (NASDAQ:PAYX), IHS Markit Ltd. (NYSE:INFO), Lululemon Athletica inc. (NASDAQ:LULU), and Consolidated Edison, Inc. (NYSE:ED). This group of stocks’ market valuations resemble YUM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAYX | 36 | 713174 | 4 |

| INFO | 29 | 729273 | -1 |

| LULU | 47 | 1133491 | -5 |

| ED | 26 | 1204354 | 2 |

| Average | 34.5 | 945073 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.5 hedge funds with bullish positions and the average amount invested in these stocks was $945 million. That figure was $463 million in YUM’s case. Lululemon Athletica inc. (NASDAQ:LULU) is the most popular stock in this table. On the other hand Consolidated Edison, Inc. (NYSE:ED) is the least popular one with only 26 bullish hedge fund positions. Yum! Brands, Inc. (NYSE:YUM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but beat the market by 12.9 percentage points. Unfortunately YUM wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on YUM were disappointed as the stock returned -16.4% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.