Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Telefonica Brasil SA (NYSE:VIV).

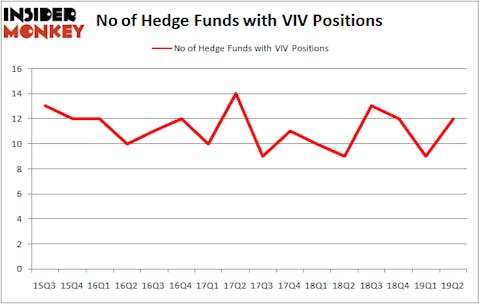

Is Telefonica Brasil SA (NYSE:VIV) going to take off soon? Hedge funds are in an optimistic mood. The number of long hedge fund positions inched up by 3 recently. Our calculations also showed that VIV isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are several gauges investors put to use to evaluate stocks. Two of the less known gauges are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the best hedge fund managers can beat their index-focused peers by a significant amount (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the latest hedge fund action encompassing Telefonica Brasil SA (NYSE:VIV).

Hedge fund activity in Telefonica Brasil SA (NYSE:VIV)

At Q2’s end, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from the previous quarter. On the other hand, there were a total of 9 hedge funds with a bullish position in VIV a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, Moerus Capital Management was the largest shareholder of Telefonica Brasil SA (NYSE:VIV), with a stake worth $36.1 million reported as of the end of March. Trailing Moerus Capital Management was AQR Capital Management, which amassed a stake valued at $3.7 million. Citadel Investment Group, Pzena Investment Management, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, some big names were leading the bulls’ herd. Citadel Investment Group, managed by Ken Griffin, assembled the biggest position in Telefonica Brasil SA (NYSE:VIV). Citadel Investment Group had $3.2 million invested in the company at the end of the quarter. Hari Hariharan’s NWI Management also made a $2 million investment in the stock during the quarter. The other funds with brand new VIV positions are Dmitry Balyasny’s Balyasny Asset Management and Minhua Zhang’s Weld Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Telefonica Brasil SA (NYSE:VIV) but similarly valued. We will take a look at KKR & Co Inc. (NYSE:KKR), Corteva, Inc. (NYSE:CTVA), Align Technology, Inc. (NASDAQ:ALGN), and Parker-Hannifin Corporation (NYSE:PH). This group of stocks’ market values are closest to VIV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KKR | 36 | 2910243 | 6 |

| CTVA | 36 | 615610 | 36 |

| ALGN | 41 | 1869260 | 11 |

| PH | 26 | 566455 | -2 |

| Average | 34.75 | 1490392 | 12.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.75 hedge funds with bullish positions and the average amount invested in these stocks was $1490 million. That figure was $56 million in VIV’s case. Align Technology, Inc. (NASDAQ:ALGN) is the most popular stock in this table. On the other hand Parker-Hannifin Corporation (NYSE:PH) is the least popular one with only 26 bullish hedge fund positions. Compared to these stocks Telefonica Brasil SA (NYSE:VIV) is even less popular than PH. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on VIV, though not to the same extent, as the stock returned 2.4% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.