Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 9 months of this year through September 30th the Standard and Poor’s 500 Index returned approximately 20% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 24% during the same 9-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like ProAssurance Corporation (NYSE:PRA).

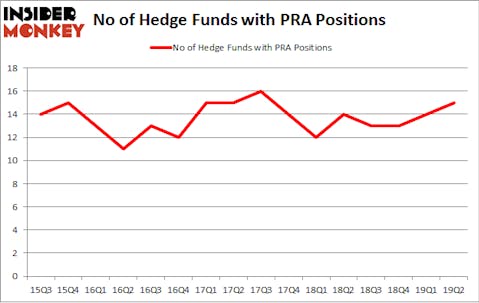

Is ProAssurance Corporation (NYSE:PRA) an exceptional investment today? Money managers are getting more optimistic. The number of long hedge fund positions advanced by 1 in recent months. Our calculations also showed that PRA isn’t among the 30 most popular stocks among hedge funds (see the video below). PRA was in 15 hedge funds’ portfolios at the end of June. There were 14 hedge funds in our database with PRA positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to view the latest hedge fund action encompassing ProAssurance Corporation (NYSE:PRA).

Hedge fund activity in ProAssurance Corporation (NYSE:PRA)

At Q2’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PRA over the last 16 quarters. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the number one position in ProAssurance Corporation (NYSE:PRA). Royce & Associates has a $59.2 million position in the stock, comprising 0.5% of its 13F portfolio. On Royce & Associates’s heels is Diamond Hill Capital, managed by Ric Dillon, which holds a $39.6 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism comprise Renaissance Technologies, Brian Ashford-Russell and Tim Woolley’s Polar Capital and Noam Gottesman’s GLG Partners.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Prospector Partners, managed by John D. Gillespie, created the biggest position in ProAssurance Corporation (NYSE:PRA). Prospector Partners had $5.7 million invested in the company at the end of the quarter. Ron Bobman’s Capital Returns Management also initiated a $0.4 million position during the quarter. The other funds with new positions in the stock are Matthew Hulsizer’s PEAK6 Capital Management and Steve Cohen’s Point72 Asset Management.

Let’s also examine hedge fund activity in other stocks similar to ProAssurance Corporation (NYSE:PRA). These stocks are Oceaneering International, Inc. (NYSE:OII), Tellurian Inc. (NASDAQ:TELL), eHealth, Inc. (NASDAQ:EHTH), and Shenandoah Telecommunications Company (NASDAQ:SHEN). This group of stocks’ market caps are closest to PRA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OII | 15 | 230924 | -6 |

| TELL | 9 | 88902 | -7 |

| EHTH | 26 | 454239 | 3 |

| SHEN | 18 | 107858 | 4 |

| Average | 17 | 220481 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $220 million. That figure was $184 million in PRA’s case. eHealth, Inc. (NASDAQ:EHTH) is the most popular stock in this table. On the other hand Tellurian Inc. (NASDAQ:TELL) is the least popular one with only 9 bullish hedge fund positions. ProAssurance Corporation (NYSE:PRA) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on PRA as the stock returned 12.4% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.