At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Is Hormel Foods Corporation (NYSE:HRL) a healthy stock for your portfolio? Money managers are turning bullish. The number of bullish hedge fund positions inched up by 1 lately. Our calculations also showed that HRL isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most stock holders, hedge funds are perceived as unimportant, outdated financial tools of the past. While there are more than 8000 funds trading at the moment, Our experts hone in on the moguls of this group, around 750 funds. It is estimated that this group of investors manage most of the smart money’s total capital, and by monitoring their finest stock picks, Insider Monkey has spotted several investment strategies that have historically surpassed the market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s check out the key hedge fund action regarding Hormel Foods Corporation (NYSE:HRL).

What have hedge funds been doing with Hormel Foods Corporation (NYSE:HRL)?

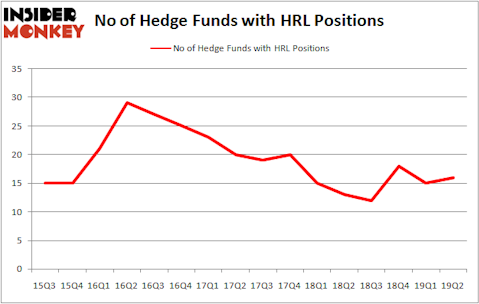

At the end of the second quarter, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in HRL over the last 16 quarters. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Cliff Asness’s AQR Capital Management has the largest position in Hormel Foods Corporation (NYSE:HRL), worth close to $63.5 million, comprising 0.1% of its total 13F portfolio. On AQR Capital Management’s heels is Alyeska Investment Group, led by Anand Parekh, holding a $30.3 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions consist of Phill Gross and Robert Atchinson’s Adage Capital Management, Noam Gottesman’s GLG Partners and Joel Greenblatt’s Gotham Asset Management.

Consequently, some big names were breaking ground themselves. Alyeska Investment Group, managed by Anand Parekh, created the largest position in Hormel Foods Corporation (NYSE:HRL). Alyeska Investment Group had $30.3 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $6.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, Ken Fisher’s Fisher Asset Management, and Ray Dalio’s Bridgewater Associates.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Hormel Foods Corporation (NYSE:HRL) but similarly valued. We will take a look at Edison International (NYSE:EIX), Realty Income Corporation (NYSE:O), Rogers Communications Inc. (NYSE:RCI), and Discovery, Inc. (NASDAQ:DISCK). This group of stocks’ market caps match HRL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EIX | 33 | 1771587 | 6 |

| O | 22 | 235043 | 7 |

| RCI | 14 | 364485 | -1 |

| DISCK | 30 | 906989 | 4 |

| Average | 24.75 | 819526 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.75 hedge funds with bullish positions and the average amount invested in these stocks was $820 million. That figure was $155 million in HRL’s case. Edison International (NYSE:EIX) is the most popular stock in this table. On the other hand Rogers Communications Inc. (NYSE:RCI) is the least popular one with only 14 bullish hedge fund positions. Hormel Foods Corporation (NYSE:HRL) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on HRL as the stock returned 8.4% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.