The market has been volatile in the last few months as the Federal Reserve continued its rate cuts and uncertainty looms over trade negotiations with China. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points over the last 12 months. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, though some funds increased their exposure dramatically at the end of Q2 and the beginning of Q3. In this article, we analyze what the smart money thinks of Extra Space Storage, Inc. (NYSE:EXR) and find out how it is affected by hedge funds’ moves.

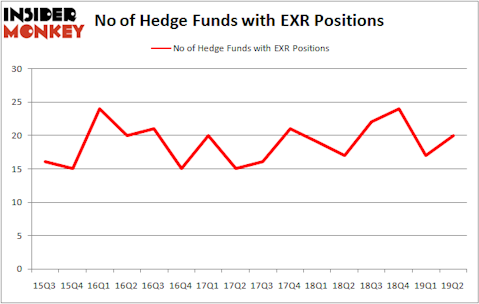

Extra Space Storage, Inc. (NYSE:EXR) has experienced an increase in hedge fund interest lately. Our calculations also showed that EXR isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike this former hedge fund manager who is convinced Dow will soar past 40000 in a year or two, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the recent hedge fund action regarding Extra Space Storage, Inc. (NYSE:EXR).

What have hedge funds been doing with Extra Space Storage, Inc. (NYSE:EXR)?

At the end of the second quarter, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18% from the first quarter of 2019. By comparison, 17 hedge funds held shares or bullish call options in EXR a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Among these funds, Millennium Management held the most valuable stake in Extra Space Storage, Inc. (NYSE:EXR), which was worth $88.5 million at the end of the second quarter. On the second spot was Citadel Investment Group which amassed $34.7 million worth of shares. Moreover, Adage Capital Management, Renaissance Technologies, and D E Shaw were also bullish on Extra Space Storage, Inc. (NYSE:EXR), allocating a large percentage of their portfolios to this stock.

Now, key money managers were leading the bulls’ herd. Centiva Capital, managed by Karim Abbadi and Edward McBride, created the biggest call position in Extra Space Storage, Inc. (NYSE:EXR). Centiva Capital had $5.3 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also initiated a $2 million position during the quarter. The following funds were also among the new EXR investors: Michael Gelband’s ExodusPoint Capital, Joel Greenblatt’s Gotham Asset Management, and Ray Dalio’s Bridgewater Associates.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Extra Space Storage, Inc. (NYSE:EXR) but similarly valued. We will take a look at Symantec Corporation (NASDAQ:SYMC), Paycom Software Inc (NYSE:PAYC), DENTSPLY SIRONA Inc. (NASDAQ:XRAY), and Celanese Corporation (NYSE:CE). This group of stocks’ market values are similar to EXR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SYMC | 35 | 1342024 | 6 |

| PAYC | 24 | 397330 | -1 |

| XRAY | 29 | 2222723 | -2 |

| CE | 20 | 635432 | -1 |

| Average | 27 | 1149377 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27 hedge funds with bullish positions and the average amount invested in these stocks was $1149 million. That figure was $185 million in EXR’s case. Symantec Corporation (NASDAQ:SYMC) is the most popular stock in this table. On the other hand Celanese Corporation (NYSE:CE) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Extra Space Storage, Inc. (NYSE:EXR) is even less popular than CE. Hedge funds clearly dropped the ball on EXR as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on EXR as the stock returned 11% during the third quarter and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.