We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind let’s see whether Verizon Communications Inc. (NYSE:VZ) represents a good buying opportunity at the moment. Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

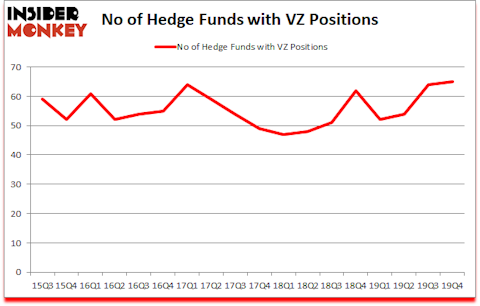

Is Verizon Communications Inc. (NYSE:VZ) a buy here? Investors who are in the know are getting more bullish. The number of long hedge fund positions inched up by 1 in recent months. Our calculations also showed that VZ isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings). VZ was in 65 hedge funds’ portfolios at the end of December. There were 64 hedge funds in our database with VZ holdings at the end of the previous quarter.

At the moment there are dozens of signals market participants put to use to value publicly traded companies. Two of the less utilized signals are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can trounce the S&P 500 by a superb margin (see the details here).

David Harding of Winton Capital Management

We leave no stone unturned when looking for the next great investment idea. For example, this trader is claiming triple digit returns, so we check out his latest trade recommendations. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s take a glance at the new hedge fund action regarding Verizon Communications Inc. (NYSE:VZ).

What does smart money think about Verizon Communications Inc. (NYSE:VZ)?

At Q4’s end, a total of 65 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 2% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards VZ over the last 18 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in Verizon Communications Inc. (NYSE:VZ), which was worth $373.5 million at the end of the third quarter. On the second spot was D E Shaw which amassed $312.8 million worth of shares. Adage Capital Management, Citadel Investment Group, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Callodine Capital Management allocated the biggest weight to Verizon Communications Inc. (NYSE:VZ), around 9.42% of its 13F portfolio. Circle Road Advisors is also relatively very bullish on the stock, setting aside 9.41 percent of its 13F equity portfolio to VZ.

As one would reasonably expect, key money managers have jumped into Verizon Communications Inc. (NYSE:VZ) headfirst. Levin Easterly Partners, managed by John Murphy, established the most valuable position in Verizon Communications Inc. (NYSE:VZ). Levin Easterly Partners had $26.7 million invested in the company at the end of the quarter. Jaime Sterne’s Skye Global Management also made a $8.2 million investment in the stock during the quarter. The other funds with new positions in the stock are David Harding’s Winton Capital Management, Donald Sussman’s Paloma Partners, and Lee Ainslie’s Maverick Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Verizon Communications Inc. (NYSE:VZ) but similarly valued. We will take a look at The Home Depot, Inc. (NYSE:HD), The Coca-Cola Company (NYSE:KO), Merck & Co., Inc. (NYSE:MRK), and Chevron Corporation (NYSE:CVX). This group of stocks’ market valuations are similar to VZ’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HD | 91 | 4996321 | 21 |

| KO | 51 | 23797078 | -5 |

| MRK | 77 | 5164143 | -3 |

| CVX | 47 | 2391610 | -6 |

| Average | 66.5 | 9087288 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 66.5 hedge funds with bullish positions and the average amount invested in these stocks was $9087 million. That figure was $1885 million in VZ’s case. The Home Depot, Inc. (NYSE:HD) is the most popular stock in this table. On the other hand Chevron Corporation (NYSE:CVX) is the least popular one with only 47 bullish hedge fund positions. Verizon Communications Inc. (NYSE:VZ) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 1.0% in 2020 through April 20th but beat the market by 11 percentage points. A small number of hedge funds were also right about betting on VZ, though not to the same extent, as the stock returned -3.3% during the same time period and outperformed the market.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.