Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4.5 years and analyze what the smart money thinks of Valero Energy Corporation (NYSE:VLO) based on that data and determine whether they were really smart about the stock.

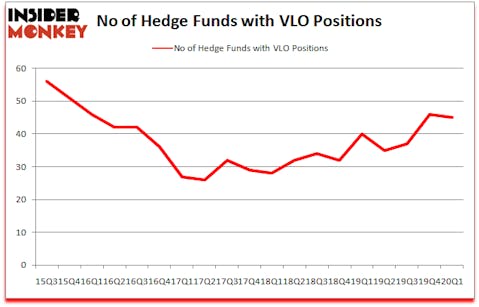

Is Valero Energy Corporation (NYSE:VLO) going to take off soon? The best stock pickers were in a pessimistic mood. The number of long hedge fund positions dropped by 1 in recent months. Our calculations also showed that VLO isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). VLO was in 45 hedge funds’ portfolios at the end of the first quarter of 2020. There were 46 hedge funds in our database with VLO positions at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a multitude of gauges investors have at their disposal to value publicly traded companies. A duo of the most innovative gauges are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the top fund managers can outperform the S&P 500 by a solid amount (see the details here).

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, this trader claims to score lucrative profits by utilizing a “weekend trading strategy”, so we look into his strategy’s picks. Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost gold prices. So, we are checking out this junior gold mining stock. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We recently recommended several stocks partly inspired by legendary Bill Miller’s investor letter. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a glance at the latest hedge fund action encompassing Valero Energy Corporation (NYSE:VLO).

How have hedgies been trading Valero Energy Corporation (NYSE:VLO)?

At Q1’s end, a total of 45 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -2% from the fourth quarter of 2019. On the other hand, there were a total of 40 hedge funds with a bullish position in VLO a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

More specifically, Citadel Investment Group was the largest shareholder of Valero Energy Corporation (NYSE:VLO), with a stake worth $57.8 million reported as of the end of September. Trailing Citadel Investment Group was Holocene Advisors, which amassed a stake valued at $40.1 million. Odey Asset Management Group, AQR Capital Management, and Adage Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Odey Asset Management Group allocated the biggest weight to Valero Energy Corporation (NYSE:VLO), around 3.99% of its 13F portfolio. Highline Capital Management is also relatively very bullish on the stock, dishing out 1.75 percent of its 13F equity portfolio to VLO.

Due to the fact that Valero Energy Corporation (NYSE:VLO) has experienced falling interest from the smart money, we can see that there was a specific group of hedgies who sold off their positions entirely last quarter. Interestingly, Israel Englander’s Millennium Management said goodbye to the largest investment of the “upper crust” of funds monitored by Insider Monkey, worth about $46.6 million in stock. Wayne Cooperman’s fund, Cobalt Capital Management, also cut its stock, about $7 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest was cut by 1 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Valero Energy Corporation (NYSE:VLO) but similarly valued. We will take a look at RingCentral Inc (NYSE:RNG), Southwest Airlines Co. (NYSE:LUV), DTE Energy Company (NYSE:DTE), and Delta Air Lines, Inc. (NYSE:DAL). This group of stocks’ market valuations match VLO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RNG | 67 | 2827940 | 5 |

| LUV | 45 | 2344803 | 1 |

| DTE | 29 | 516788 | -6 |

| DAL | 53 | 2970479 | -17 |

| Average | 48.5 | 2165003 | -4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 48.5 hedge funds with bullish positions and the average amount invested in these stocks was $2165 million. That figure was $276 million in VLO’s case. RingCentral Inc (NYSE:RNG) is the most popular stock in this table. On the other hand DTE Energy Company (NYSE:DTE) is the least popular one with only 29 bullish hedge fund positions. Valero Energy Corporation (NYSE:VLO) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th and still beat the market by 15.5 percentage points. A small number of hedge funds were also right about betting on VLO as the stock returned 31.7% during the second quarter and outperformed the market by an even larger margin.

Follow Valero Energy Corp (NYSE:VLO)

Follow Valero Energy Corp (NYSE:VLO)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.