We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Twilio Inc. (NYSE:TWLO).

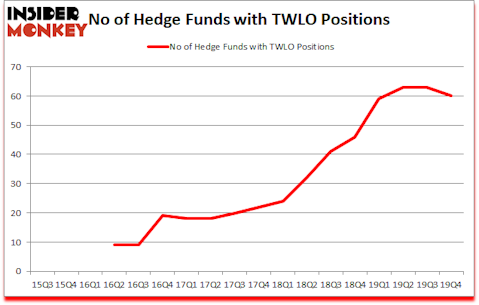

Is Twilio Inc. (NYSE:TWLO) going to take off soon? Money managers are getting less optimistic. The number of long hedge fund positions were trimmed by 3 recently. Our calculations also showed that TWLO isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In today’s marketplace there are numerous methods market participants put to use to grade their holdings. Two of the best methods are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the top fund managers can outclass the S&P 500 by a healthy margin (see the details here).

We leave no stone unturned when looking for the next great investment idea. For example, this trader is claiming triple digit returns, so we check out his latest trade recommendations. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a look at the new hedge fund action encompassing Twilio Inc. (NYSE:TWLO).

What does smart money think about Twilio Inc. (NYSE:TWLO)?

At Q4’s end, a total of 60 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -5% from one quarter earlier. On the other hand, there were a total of 46 hedge funds with a bullish position in TWLO a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

More specifically, Generation Investment Management was the largest shareholder of Twilio Inc. (NYSE:TWLO), with a stake worth $330.6 million reported as of the end of September. Trailing Generation Investment Management was Tybourne Capital Management, which amassed a stake valued at $323.3 million. Foxhaven Asset Management, SCGE Management, and Tiger Global Management LLC were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Tybourne Capital Management allocated the biggest weight to Twilio Inc. (NYSE:TWLO), around 12.39% of its 13F portfolio. Foxhaven Asset Management is also relatively very bullish on the stock, designating 12.3 percent of its 13F equity portfolio to TWLO.

Judging by the fact that Twilio Inc. (NYSE:TWLO) has experienced bearish sentiment from the aggregate hedge fund industry, it’s safe to say that there is a sect of hedgies that decided to sell off their full holdings by the end of the third quarter. At the top of the heap, Daniel Sundheim’s D1 Capital Partners sold off the largest stake of the “upper crust” of funds followed by Insider Monkey, comprising close to $99.8 million in stock. Philippe Laffont’s fund, Coatue Management, also sold off its stock, about $86.2 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 3 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Twilio Inc. (NYSE:TWLO). These stocks are Annaly Capital Management, Inc. (NYSE:NLY), HEICO Corporation (NYSE:HEI), Cboe Global Markets, Inc. (NASDAQ:CBOE), and Plains All American Pipeline, L.P. (NYSE:PAA). This group of stocks’ market caps resemble TWLO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NLY | 21 | 219868 | 5 |

| HEI | 57 | 1205133 | 11 |

| CBOE | 27 | 1050257 | 1 |

| PAA | 12 | 168993 | -5 |

| Average | 29.25 | 661063 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.25 hedge funds with bullish positions and the average amount invested in these stocks was $661 million. That figure was $2101 million in TWLO’s case. HEICO Corporation (NYSE:HEI) is the most popular stock in this table. On the other hand Plains All American Pipeline, L.P. (NYSE:PAA) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Twilio Inc. (NYSE:TWLO) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 1.0% in 2020 through April 20th but still managed to beat the market by 11 percentage points. Hedge funds were also right about betting on TWLO as the stock returned 10.3% so far in 2020 (through April 20th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.