In this article you are going to find out whether hedge funds think TransDigm Group Incorporated (NYSE:TDG) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

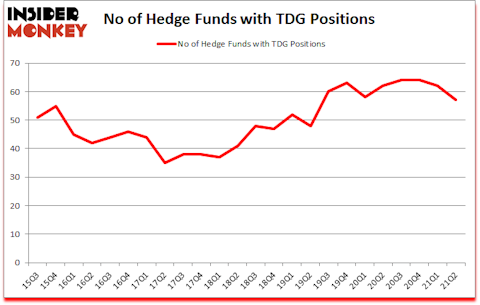

Is TransDigm Group Incorporated (NYSE:TDG) a healthy stock for your portfolio? Money managers were selling. The number of long hedge fund positions were cut by 5 recently. TransDigm Group Incorporated (NYSE:TDG) was in 57 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 64. Our calculations also showed that TDG isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

To most traders, hedge funds are assumed to be unimportant, old financial tools of yesteryear. While there are over 8000 funds in operation at the moment, Our researchers choose to focus on the elite of this club, around 850 funds. These hedge fund managers command bulk of all hedge funds’ total capital, and by keeping an eye on their best equity investments, Insider Monkey has deciphered several investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, the demand for helium is soaring and there is a helium supply shortage, so we are checking out stock pitches like this emerging helium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s take a look at the new hedge fund action regarding TransDigm Group Incorporated (NYSE:TDG).

Do Hedge Funds Think TDG Is A Good Stock To Buy Now?

Heading into the third quarter of 2021, a total of 57 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from one quarter earlier. By comparison, 62 hedge funds held shares or bullish call options in TDG a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

The largest stake in TransDigm Group Incorporated (NYSE:TDG) was held by Tiger Global Management LLC, which reported holding $1137.4 million worth of stock at the end of June. It was followed by Stockbridge Partners with a $1006.2 million position. Other investors bullish on the company included AltaRock Partners, Matrix Capital Management, and Windacre Partnership. In terms of the portfolio weights assigned to each position Anabranch Capital allocated the biggest weight to TransDigm Group Incorporated (NYSE:TDG), around 24.6% of its 13F portfolio. AltaRock Partners is also relatively very bullish on the stock, setting aside 22.51 percent of its 13F equity portfolio to TDG.

Judging by the fact that TransDigm Group Incorporated (NYSE:TDG) has witnessed declining sentiment from the smart money, it’s easy to see that there was a specific group of funds who were dropping their entire stakes in the second quarter. Interestingly, Dmitry Balyasny’s Balyasny Asset Management sold off the largest stake of the “upper crust” of funds followed by Insider Monkey, comprising about $72.1 million in stock. Benjamin A. Smith’s fund, Laurion Capital Management, also dumped its stock, about $11.3 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 5 funds in the second quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as TransDigm Group Incorporated (NYSE:TDG) but similarly valued. These stocks are Xcel Energy Inc (NASDAQ:XEL), Brown-Forman Corporation (NYSE:BF), Alcon Inc. (NYSE:ALC), Republic Services, Inc. (NYSE:RSG), Otis Worldwide Corporation (NYSE:OTIS), SBA Communications Corporation (NASDAQ:SBAC), and Corning Incorporated (NYSE:GLW). This group of stocks’ market values are similar to TDG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XEL | 22 | 235410 | 4 |

| BF | 31 | 1667783 | -4 |

| ALC | 22 | 727825 | -1 |

| RSG | 34 | 1289299 | -2 |

| OTIS | 45 | 2406679 | -7 |

| SBAC | 43 | 2156941 | 5 |

| GLW | 42 | 521738 | 10 |

| Average | 34.1 | 1286525 | 0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.1 hedge funds with bullish positions and the average amount invested in these stocks was $1287 million. That figure was $7352 million in TDG’s case. Otis Worldwide Corporation (NYSE:OTIS) is the most popular stock in this table. On the other hand Xcel Energy Inc (NASDAQ:XEL) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks TransDigm Group Incorporated (NYSE:TDG) is more popular among hedge funds. Our overall hedge fund sentiment score for TDG is 76.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 26.3% in 2021 through October 29th and still beat the market by 2.3 percentage points. Unfortunately TDG wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on TDG were disappointed as the stock returned -3.6% since the end of the second quarter (through 10/29) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Transdigm Group Inc (NYSE:TDG)

Follow Transdigm Group Inc (NYSE:TDG)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Best News and Reading Apps

- 10 Best Tech Stocks to Buy According to Japanese Billionaire Masayoshi Son

- Billionaire David Siegel’s Top 10 Stock Picks

Disclosure: None. This article was originally published at Insider Monkey.