The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on December 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Service Corporation International (NYSE:SCI) based on those filings.

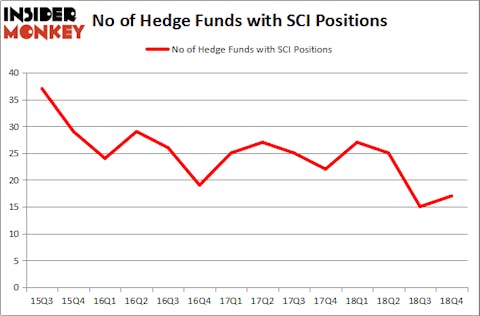

Service Corporation International (NYSE:SCI) investors should be aware of an increase in hedge fund sentiment during Q4, however, overall hedge fund sentiment towards the stock is still near its all time low. Our calculations also showed that SCI isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the latest hedge fund action regarding Service Corporation International (NYSE:SCI).

How have hedgies been trading Service Corporation International (NYSE:SCI)?

Heading into the first quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from one quarter earlier. On the other hand, there were a total of 27 hedge funds with a bullish position in SCI a year ago. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

More specifically, Select Equity Group was the largest shareholder of Service Corporation International (NYSE:SCI), with a stake worth $413.1 million reported as of the end of September. Trailing Select Equity Group was AQR Capital Management, which amassed a stake valued at $31.6 million. Renaissance Technologies, Two Sigma Advisors, and Tamarack Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key hedge funds were leading the bulls’ herd. Balyasny Asset Management, managed by Dmitry Balyasny, created the most valuable position in Service Corporation International (NYSE:SCI). Balyasny Asset Management had $6.1 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $2.7 million position during the quarter. The other funds with new positions in the stock are Ian Simm’s Impax Asset Management, David Harding’s Winton Capital Management, and Ray Dalio’s Bridgewater Associates.

Let’s now take a look at hedge fund activity in other stocks similar to Service Corporation International (NYSE:SCI). We will take a look at Cemex SAB de CV (NYSE:CX), Hyatt Hotels Corporation (NYSE:H), West Pharmaceutical Services Inc. (NYSE:WST), and A. O. Smith Corporation (NYSE:AOS). This group of stocks’ market caps are closest to SCI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CX | 10 | 100016 | -3 |

| H | 25 | 638419 | -6 |

| WST | 20 | 203499 | 3 |

| AOS | 29 | 503949 | -4 |

| Average | 21 | 361471 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $361 million. That figure was $524 million in SCI’s case. A. O. Smith Corporation (NYSE:AOS) is the most popular stock in this table. On the other hand Cemex SAB de CV (NYSE:CX) is the least popular one with only 10 bullish hedge fund positions. Service Corporation International (NYSE:SCI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately SCI wasn’t in this group. Hedge funds that bet on SCI were disappointed as the stock returned only 3.0% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.