Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index returned approximately 13.1% in the first 2.5 months of this year (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. An average long/short hedge fund returned only 5% due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Loews Corporation (NYSE:L).

Loews Corporation (NYSE:L) investors should be aware of a decrease in hedge fund sentiment recently. Our calculations also showed that L isn’t among the 30 most popular stocks among hedge funds.

According to most investors, hedge funds are seen as slow, outdated financial vehicles of the past. While there are more than 8000 funds in operation at present, Our researchers look at the bigwigs of this group, about 750 funds. These money managers shepherd bulk of the hedge fund industry’s total asset base, and by keeping an eye on their finest investments, Insider Monkey has figured out a few investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a peek at the latest hedge fund action surrounding Loews Corporation (NYSE:L).

What does the smart money think about Loews Corporation (NYSE:L)?

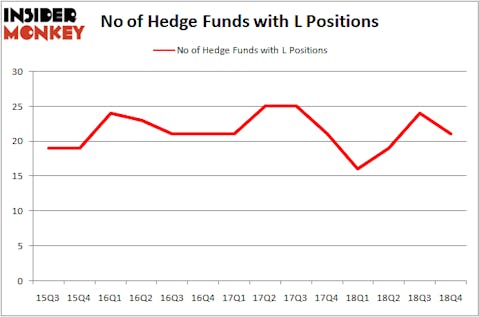

At Q4’s end, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -13% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards L over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Diamond Hill Capital was the largest shareholder of Loews Corporation (NYSE:L), with a stake worth $247.3 million reported as of the end of September. Trailing Diamond Hill Capital was Wallace Capital Management, which amassed a stake valued at $18.5 million. Levin Capital Strategies, D E Shaw, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Loews Corporation (NYSE:L) has experienced declining sentiment from the aggregate hedge fund industry, logic holds that there was a specific group of hedge funds who were dropping their entire stakes in the third quarter. Interestingly, Matthew Tewksbury’s Stevens Capital Management cut the biggest stake of all the hedgies watched by Insider Monkey, totaling close to $2.2 million in stock, and George Hall’s Clinton Group was right behind this move, as the fund cut about $1.5 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 3 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Loews Corporation (NYSE:L) but similarly valued. These stocks are Waters Corporation (NYSE:WAT), Best Buy Co., Inc. (NYSE:BBY), Fortis Inc. (NYSE:FTS), and Mettler-Toledo International Inc. (NYSE:MTD). This group of stocks’ market values resemble L’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WAT | 32 | 894358 | 9 |

| BBY | 23 | 630609 | -4 |

| FTS | 14 | 253251 | 0 |

| MTD | 22 | 241720 | 6 |

| Average | 22.75 | 504985 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $505 million. That figure was $314 million in L’s case. Waters Corporation (NYSE:WAT) is the most popular stock in this table. On the other hand Fortis Inc. (NYSE:FTS) is the least popular one with only 14 bullish hedge fund positions. Loews Corporation (NYSE:L) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately Loews wasn’t in this group. Hedge funds that bet on Loews were disappointed as the stock returned 5.1% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.