You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

Is Kohl’s Corporation (NYSE:KSS) a good stock to buy now? Prominent investors are turning less bullish. The number of bullish hedge fund positions dropped by 2 in recent months. Our calculations also showed that KSS isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to check out the key hedge fund action encompassing Kohl’s Corporation (NYSE:KSS).

What have hedge funds been doing with Kohl’s Corporation (NYSE:KSS)?

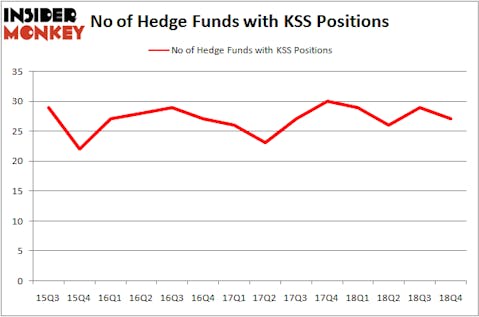

Heading into the first quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from the previous quarter. The graph below displays the number of hedge funds with bullish position in KSS over the last 14 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the largest position in Kohl’s Corporation (NYSE:KSS). AQR Capital Management has a $542.1 million position in the stock, comprising 0.6% of its 13F portfolio. The second largest stake is held by Renaissance Technologies, managed by Jim Simons, which holds a $261.6 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism include Robert Pohly’s Samlyn Capital, John Overdeck and David Siegel’s Two Sigma Advisors and Ken Griffin’s Citadel Investment Group.

Due to the fact that Kohl’s Corporation (NYSE:KSS) has experienced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there exists a select few hedge funds that elected to cut their positions entirely last quarter. It’s worth mentioning that Per Johanssoná’s Bodenholm Capital said goodbye to the biggest stake of the 700 funds tracked by Insider Monkey, valued at an estimated $9.2 million in stock. Jeffrey Talpins’s fund, Element Capital Management, also sold off its stock, about $7.8 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 2 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Kohl’s Corporation (NYSE:KSS) but similarly valued. These stocks are Cboe Global Markets, Inc. (NASDAQ:CBOE), UDR, Inc. (NYSE:UDR), Mid America Apartment Communities Inc (NYSE:MAA), and Atmos Energy Corporation (NYSE:ATO). All of these stocks’ market caps are closest to KSS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBOE | 24 | 815080 | 3 |

| UDR | 20 | 669432 | 4 |

| MAA | 21 | 300039 | 6 |

| ATO | 25 | 327214 | 10 |

| Average | 22.5 | 527941 | 5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $528 million. That figure was $1032 million in KSS’s case. Atmos Energy Corporation (NYSE:ATO) is the most popular stock in this table. On the other hand UDR, Inc. (NYSE:UDR) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Kohl’s Corporation (NYSE:KSS) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately KSS wasn’t in this group. Hedge funds that bet on KSS were disappointed as the stock returned 2.5% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.