The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 821 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, a week after the market trough. We are almost done with the second quarter. Investors decided to bet on the economic recovery and a stock market rebound. S&P 500 Index returned almost 20% this quarter. In this article we look at how hedge funds traded Sleep Number Corporation (NASDAQ:SNBR) and determine whether the smart money was really smart about this stock.

Hedge fund interest in Sleep Number Corporation (NASDAQ:SNBR) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare SNBR to other stocks including NV5 Global Inc (NASDAQ:NVEE), ConnectOne Bancorp Inc (NASDAQ:CNOB), and Bed Bath & Beyond Inc. (NASDAQ:BBBY) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Jim Simons Founder of Renaissance Technologies

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Cannabis stocks are roaring back in 2020, so we are checking out this under-the-radar stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. Keeping this in mind we’re going to view the fresh hedge fund action encompassing Sleep Number Corporation (NASDAQ:SNBR).

How are hedge funds trading Sleep Number Corporation (NASDAQ:SNBR)?

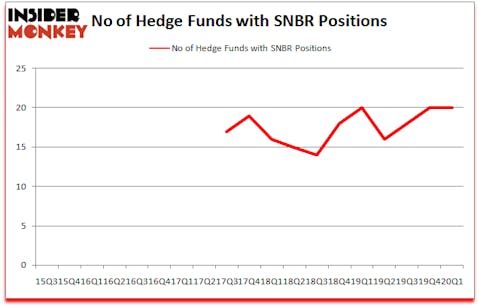

At the end of the first quarter, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SNBR over the last 18 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, D E Shaw, managed by D. E. Shaw, holds the number one position in Sleep Number Corporation (NASDAQ:SNBR). D E Shaw has a $17.2 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Sitting at the No. 2 spot is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $14.9 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Other members of the smart money that hold long positions encompass Noam Gottesman’s GLG Partners, Ken Griffin’s Citadel Investment Group and Francois Rochon’s Giverny Capital. In terms of the portfolio weights assigned to each position Giverny Capital allocated the biggest weight to Sleep Number Corporation (NASDAQ:SNBR), around 0.53% of its 13F portfolio. Quantinno Capital is also relatively very bullish on the stock, designating 0.29 percent of its 13F equity portfolio to SNBR.

Since Sleep Number Corporation (NASDAQ:SNBR) has faced falling interest from the entirety of the hedge funds we track, it’s easy to see that there exists a select few fund managers who sold off their entire stakes last quarter. It’s worth mentioning that Paul Marshall and Ian Wace’s Marshall Wace LLP dropped the biggest stake of the 750 funds tracked by Insider Monkey, worth close to $3.8 million in stock, and Donald Sussman’s Paloma Partners was right behind this move, as the fund cut about $0.9 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Sleep Number Corporation (NASDAQ:SNBR) but similarly valued. We will take a look at NV5 Global Inc (NASDAQ:NVEE), ConnectOne Bancorp Inc (NASDAQ:CNOB), Bed Bath & Beyond Inc. (NASDAQ:BBBY), and RadNet Inc. (NASDAQ:RDNT). This group of stocks’ market values resemble SNBR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NVEE | 9 | 11304 | 0 |

| CNOB | 11 | 32159 | 0 |

| BBBY | 28 | 137258 | -6 |

| RDNT | 16 | 33104 | 2 |

| Average | 16 | 53456 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $53 million. That figure was $65 million in SNBR’s case. Bed Bath & Beyond Inc. (NASDAQ:BBBY) is the most popular stock in this table. On the other hand NV5 Global Inc (NASDAQ:NVEE) is the least popular one with only 9 bullish hedge fund positions. Sleep Number Corporation (NASDAQ:SNBR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 18.6% in 2020 through July 27th but still beat the market by 17.1 percentage points. Hedge funds were also right about betting on SNBR as the stock returned 134.1% since Q1 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Sleep Number Corp (NASDAQ:SNBR)

Follow Sleep Number Corp (NASDAQ:SNBR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.