Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of STAAR Surgical Company (NASDAQ:STAA).

Is STAAR Surgical Company (NASDAQ:STAA) a buy here? The best stock pickers are selling. The number of bullish hedge fund bets were trimmed by 5 lately. Our calculations also showed that STAA isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the fresh hedge fund action encompassing STAAR Surgical Company (NASDAQ:STAA).

Hedge fund activity in STAAR Surgical Company (NASDAQ:STAA)

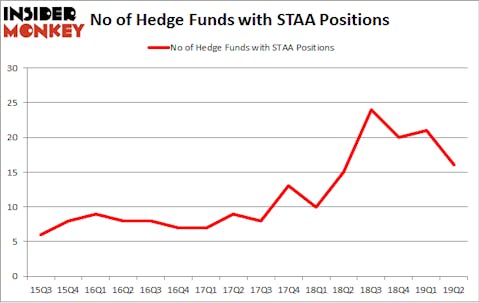

At Q2’s end, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -24% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards STAA over the last 16 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Broadwood Capital held the most valuable stake in STAAR Surgical Company (NASDAQ:STAA), which was worth $318.5 million at the end of the second quarter. On the second spot was Palo Alto Investors which amassed $124.5 million worth of shares. Moreover, Deerfield Management, Pura Vida Investments, and Marshall Wace LLP were also bullish on STAAR Surgical Company (NASDAQ:STAA), allocating a large percentage of their portfolios to this stock.

Seeing as STAAR Surgical Company (NASDAQ:STAA) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there were a few hedge funds who were dropping their full holdings heading into Q3. It’s worth mentioning that Roberto Mignone’s Bridger Management sold off the largest stake of the 750 funds followed by Insider Monkey, valued at an estimated $17.6 million in stock, and Minhua Zhang’s Weld Capital Management was right behind this move, as the fund sold off about $0.6 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 5 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to STAAR Surgical Company (NASDAQ:STAA). These stocks are Hawaiian Holdings, Inc. (NASDAQ:HA), Canadian Solar Inc. (NASDAQ:CSIQ), Warrior Met Coal, Inc. (NYSE:HCC), and First Commonwealth Financial Corporation (NYSE:FCF). This group of stocks’ market caps match STAA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HA | 11 | 93991 | -3 |

| CSIQ | 13 | 142467 | 2 |

| HCC | 31 | 391656 | -4 |

| FCF | 12 | 38937 | -3 |

| Average | 16.75 | 166763 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $167 million. That figure was $556 million in STAA’s case. Warrior Met Coal, Inc. (NYSE:HCC) is the most popular stock in this table. On the other hand Hawaiian Holdings, Inc. (NASDAQ:HA) is the least popular one with only 11 bullish hedge fund positions. STAAR Surgical Company (NASDAQ:STAA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately STAA wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); STAA investors were disappointed as the stock returned -12.3% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.