Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

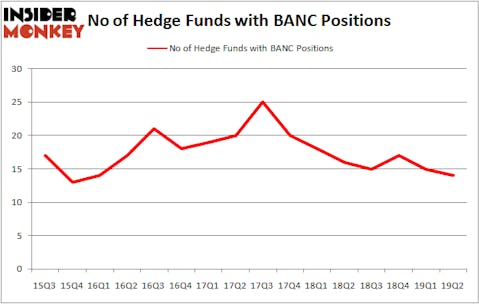

Is Banc of California, Inc. (NYSE:BANC) a buy, sell, or hold? Hedge funds are taking a bearish view. The number of long hedge fund positions shrunk by 1 recently. Our calculations also showed that BANC isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a large number of metrics market participants employ to assess their holdings. Some of the most under-the-radar metrics are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the top money managers can trounce their index-focused peers by a healthy amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a glance at the fresh hedge fund action regarding Banc of California, Inc. (NYSE:BANC).

How are hedge funds trading Banc of California, Inc. (NYSE:BANC)?

At the end of the second quarter, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of -7% from the first quarter of 2019. By comparison, 16 hedge funds held shares or bullish call options in BANC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, EJF Capital, managed by Emanuel J. Friedman, holds the biggest position in Banc of California, Inc. (NYSE:BANC). EJF Capital has a $27.9 million position in the stock, comprising 3.5% of its 13F portfolio. Sitting at the No. 2 spot is Michael Price of MFP Investors, with a $18.7 million position; the fund has 2.4% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism consist of Mark Lee’s Forest Hill Capital, Tom Brown’s Second Curve Capital and Anton Schutz’s Mendon Capital Advisors.

Because Banc of California, Inc. (NYSE:BANC) has witnessed declining sentiment from the aggregate hedge fund industry, we can see that there was a specific group of money managers who sold off their entire stakes heading into Q3. Intriguingly, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital said goodbye to the biggest stake of the 750 funds followed by Insider Monkey, comprising close to $0.9 million in stock. Ken Fisher’s fund, Fisher Asset Management, also dropped its stock, about $0.7 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 1 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Banc of California, Inc. (NYSE:BANC) but similarly valued. These stocks are ArcBest Corp (NASDAQ:ARCB), AdvanSix Inc. (NYSE:ASIX), Luxfer Holdings PLC (NYSE:LXFR), and Comtech Telecommunications Corp. (NASDAQ:CMTL). This group of stocks’ market caps resemble BANC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARCB | 16 | 62849 | 4 |

| ASIX | 15 | 115979 | -4 |

| LXFR | 9 | 106556 | -5 |

| CMTL | 17 | 106760 | -3 |

| Average | 14.25 | 98036 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $98 million. That figure was $87 million in BANC’s case. Comtech Telecommunications Corp. (NASDAQ:CMTL) is the most popular stock in this table. On the other hand Luxfer Holdings PLC (NYSE:LXFR) is the least popular one with only 9 bullish hedge fund positions. Banc of California, Inc. (NYSE:BANC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately BANC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); BANC investors were disappointed as the stock returned 1.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.