Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. After several tireless days we have finished crunching the numbers from nearly 835 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of December 31st. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards SAP SE (NYSE:SAP).

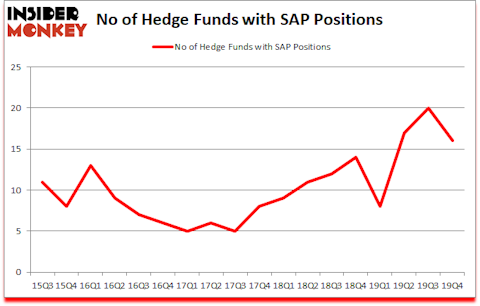

SAP SE (NYSE:SAP) investors should pay attention to a decrease in activity from the world’s largest hedge funds recently. SAP was in 16 hedge funds’ portfolios at the end of December. There were 20 hedge funds in our database with SAP holdings at the end of the previous quarter. Our calculations also showed that SAP isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

To most traders, hedge funds are viewed as unimportant, outdated investment tools of yesteryear. While there are greater than 8000 funds trading today, We look at the upper echelon of this group, approximately 850 funds. These investment experts shepherd bulk of all hedge funds’ total capital, and by monitoring their highest performing investments, Insider Monkey has spotted a few investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Paul Singer of Elliott Management

We leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we are checking out investment opportunities like this one. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s check out the latest hedge fund action encompassing SAP SE (NYSE:SAP).

How have hedgies been trading SAP SE (NYSE:SAP)?

At the end of the fourth quarter, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -20% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in SAP over the last 18 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

More specifically, Fisher Asset Management was the largest shareholder of SAP SE (NYSE:SAP), with a stake worth $1025.6 million reported as of the end of September. Trailing Fisher Asset Management was GQG Partners, which amassed a stake valued at $335.5 million. Holocene Advisors, Elliott Management, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Akaris Global Partners allocated the biggest weight to SAP SE (NYSE:SAP), around 10.15% of its 13F portfolio. Unio Capital is also relatively very bullish on the stock, dishing out 5.4 percent of its 13F equity portfolio to SAP.

Judging by the fact that SAP SE (NYSE:SAP) has experienced a decline in interest from the entirety of the hedge funds we track, we can see that there were a few hedge funds who were dropping their full holdings last quarter. It’s worth mentioning that Eric W. Mandelblatt and Gaurav Kapadia’s Soroban Capital Partners cut the largest investment of the “upper crust” of funds watched by Insider Monkey, worth close to $4.1 million in call options. Gavin Saitowitz and Cisco J. del Valle’s fund, Springbok Capital, also said goodbye to its call options, about $1.8 million worth. These transactions are interesting, as aggregate hedge fund interest was cut by 4 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to SAP SE (NYSE:SAP). We will take a look at Anheuser-Busch InBev SA/NV (NYSE:BUD), Adobe Inc. (NASDAQ:ADBE), HSBC Holdings plc (NYSE:HSBC), and NIKE, Inc. (NYSE:NKE). This group of stocks’ market valuations are similar to SAP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BUD | 23 | 1478846 | 2 |

| ADBE | 106 | 9784116 | 4 |

| HSBC | 18 | 1118976 | 2 |

| NKE | 81 | 2510260 | 12 |

| Average | 57 | 3723050 | 5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 57 hedge funds with bullish positions and the average amount invested in these stocks was $3723 million. That figure was $1764 million in SAP’s case. Adobe Inc. (NASDAQ:ADBE) is the most popular stock in this table. On the other hand HSBC Holdings plc (NYSE:HSBC) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks SAP SE (NYSE:SAP) is even less popular than HSBC. Hedge funds dodged a bullet by taking a bearish stance towards SAP. Our calculations showed that the top 10 most popular hedge fund stocks returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but managed to beat the market by 12.9 percentage points. Unfortunately SAP wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was very bearish); SAP investors were disappointed as the stock returned -12.7% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market so far in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.