At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Qorvo Inc (NASDAQ:QRVO) at the end of the first quarter and determine whether the smart money was really smart about this stock.

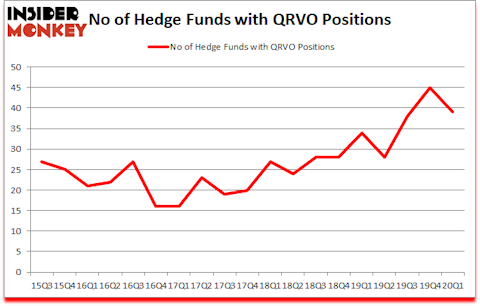

Qorvo Inc (NASDAQ:QRVO) investors should pay attention to a decrease in activity from the world’s largest hedge funds lately. Our calculations also showed that QRVO isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 36% through May 18th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than tripled this year. We are trying to identify other EV revolution winners, so we are checking out this tiny lithium stock. With all of this in mind we’re going to review the latest hedge fund action regarding Qorvo Inc (NASDAQ:QRVO).

How have hedgies been trading Qorvo Inc (NASDAQ:QRVO)?

At Q1’s end, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from the previous quarter. On the other hand, there were a total of 34 hedge funds with a bullish position in QRVO a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Baupost Group, managed by Seth Klarman, holds the most valuable position in Qorvo Inc (NASDAQ:QRVO). Baupost Group has a $246.9 million position in the stock, comprising 3.6% of its 13F portfolio. Sitting at the No. 2 spot is AQR Capital Management, led by Cliff Asness, holding a $226.4 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions consist of Renaissance Technologies, David Cohen and Harold Levy’s Iridian Asset Management and Ken Fisher’s Fisher Asset Management. In terms of the portfolio weights assigned to each position Scion Asset Management allocated the biggest weight to Qorvo Inc (NASDAQ:QRVO), around 11.74% of its 13F portfolio. Mondrian Capital is also relatively very bullish on the stock, designating 3.91 percent of its 13F equity portfolio to QRVO.

Seeing as Qorvo Inc (NASDAQ:QRVO) has witnessed falling interest from the smart money, we can see that there exists a select few hedge funds that elected to cut their positions entirely by the end of the first quarter. Intriguingly, Brandon Haley’s Holocene Advisors cut the largest investment of the 750 funds monitored by Insider Monkey, totaling an estimated $37.4 million in stock. John Hurley’s fund, Cavalry Asset Management, also dumped its stock, about $33.2 million worth. These bearish behaviors are important to note, as total hedge fund interest fell by 6 funds by the end of the first quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Qorvo Inc (NASDAQ:QRVO) but similarly valued. These stocks are Varian Medical Systems, Inc. (NYSE:VAR), Suzano S.A. (NYSE:SUZ), Hologic, Inc. (NASDAQ:HOLX), and Wabtec Corporation (NYSE:WAB). This group of stocks’ market valuations are closest to QRVO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VAR | 25 | 439921 | -5 |

| SUZ | 3 | 27219 | -1 |

| HOLX | 41 | 866159 | 0 |

| WAB | 41 | 1405445 | 0 |

| Average | 27.5 | 684686 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.5 hedge funds with bullish positions and the average amount invested in these stocks was $685 million. That figure was $1166 million in QRVO’s case. Hologic, Inc. (NASDAQ:HOLX) is the most popular stock in this table. On the other hand Suzano S.A. (NYSE:SUZ) is the least popular one with only 3 bullish hedge fund positions. Qorvo Inc (NASDAQ:QRVO) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th but still beat the market by 15.5 percentage points. Hedge funds were also right about betting on QRVO as the stock returned 37.1% in Q2 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Qorvo Inc. (NASDAQ:QRVO)

Follow Qorvo Inc. (NASDAQ:QRVO)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.