Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in 51job, Inc. (NASDAQ:JOBS)? The smart money sentiment can provide an answer to this question.

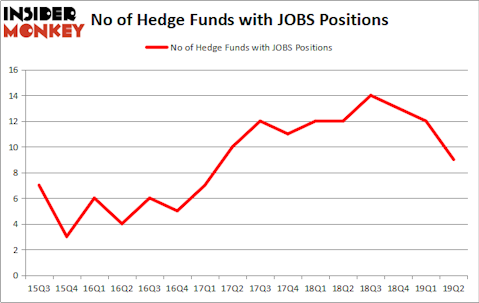

Is 51job, Inc. (NASDAQ:JOBS) a bargain? Hedge funds are in a pessimistic mood. The number of bullish hedge fund positions were trimmed by 3 recently. Our calculations also showed that JOBS isn’t among the 30 most popular stocks among hedge funds (see the video below). JOBS was in 9 hedge funds’ portfolios at the end of the second quarter of 2019. There were 12 hedge funds in our database with JOBS positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are tons of gauges investors put to use to size up stocks. Two of the most underrated gauges are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the top money managers can outpace their index-focused peers by a superb margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the key hedge fund action surrounding 51job, Inc. (NASDAQ:JOBS).

How have hedgies been trading 51job, Inc. (NASDAQ:JOBS)?

At Q2’s end, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from the first quarter of 2019. By comparison, 12 hedge funds held shares or bullish call options in JOBS a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Sensato Capital Management was the largest shareholder of 51job, Inc. (NASDAQ:JOBS), with a stake worth $7.5 million reported as of the end of March. Trailing Sensato Capital Management was Fisher Asset Management, which amassed a stake valued at $6.4 million. Sloane Robinson Investment Management, Bridgewater Associates, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that 51job, Inc. (NASDAQ:JOBS) has faced declining sentiment from the entirety of the hedge funds we track, we can see that there exists a select few funds that decided to sell off their full holdings heading into Q3. It’s worth mentioning that Ken Griffin’s Citadel Investment Group cut the largest investment of the “upper crust” of funds followed by Insider Monkey, comprising about $109.3 million in stock. Michael Platt and William Reeves’s fund, BlueCrest Capital Mgmt., also dumped its stock, about $12.4 million worth. These bearish behaviors are important to note, as total hedge fund interest fell by 3 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to 51job, Inc. (NASDAQ:JOBS). These stocks are Avnet, Inc. (NYSE:AVT), New York Community Bancorp, Inc. (NYSE:NYCB), Churchill Downs Incorporated (NASDAQ:CHDN), and Essent Group Ltd (NYSE:ESNT). This group of stocks’ market values resemble JOBS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVT | 27 | 609308 | 10 |

| NYCB | 19 | 194360 | 7 |

| CHDN | 25 | 681457 | -4 |

| ESNT | 30 | 325693 | 3 |

| Average | 25.25 | 452705 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.25 hedge funds with bullish positions and the average amount invested in these stocks was $453 million. That figure was $22 million in JOBS’s case. Essent Group Ltd (NYSE:ESNT) is the most popular stock in this table. On the other hand New York Community Bancorp, Inc. (NYSE:NYCB) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks 51job, Inc. (NASDAQ:JOBS) is even less popular than NYCB. Hedge funds dodged a bullet by taking a bearish stance towards JOBS. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately JOBS wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); JOBS investors were disappointed as the stock returned -2% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.