We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. We at Insider Monkey have gone over 835 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of Portola Pharmaceuticals Inc (NASDAQ:PTLA) based on that data.

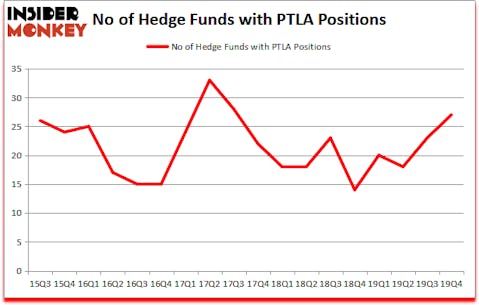

Is Portola Pharmaceuticals Inc (NASDAQ:PTLA) an excellent investment right now? The smart money is turning bullish. The number of long hedge fund positions rose by 4 in recent months. Our calculations also showed that PTLA isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings). PTLA was in 27 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 23 hedge funds in our database with PTLA holdings at the end of the previous quarter.

If you’d ask most traders, hedge funds are seen as slow, outdated financial vehicles of the past. While there are greater than 8000 funds trading today, Our experts hone in on the elite of this club, around 850 funds. Most estimates calculate that this group of people preside over most of the smart money’s total capital, and by keeping track of their best stock picks, Insider Monkey has deciphered several investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Kris Jenner of Rock Springs Capital Management

With all of this in mind we’re going to check out the fresh hedge fund action encompassing Portola Pharmaceuticals Inc (NASDAQ:PTLA).

What have hedge funds been doing with Portola Pharmaceuticals Inc (NASDAQ:PTLA)?

Heading into the first quarter of 2020, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards PTLA over the last 18 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Eric Bannasch’s Cadian Capital has the most valuable position in Portola Pharmaceuticals Inc (NASDAQ:PTLA), worth close to $50.9 million, comprising 2.3% of its total 13F portfolio. On Cadian Capital’s heels is James Dondero of Highland Capital Management, with a $36.8 million position; 2.8% of its 13F portfolio is allocated to the stock. Remaining members of the smart money with similar optimism include Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management, Phill Gross and Robert Atchinson’s Adage Capital Management and Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management. In terms of the portfolio weights assigned to each position Tamarack Capital Management allocated the biggest weight to Portola Pharmaceuticals Inc (NASDAQ:PTLA), around 3.26% of its 13F portfolio. Highland Capital Management is also relatively very bullish on the stock, dishing out 2.79 percent of its 13F equity portfolio to PTLA.

Now, specific money managers have jumped into Portola Pharmaceuticals Inc (NASDAQ:PTLA) headfirst. Parkman Healthcare Partners, managed by Greg Martinez, initiated the most outsized position in Portola Pharmaceuticals Inc (NASDAQ:PTLA). Parkman Healthcare Partners had $6.6 million invested in the company at the end of the quarter. Renaissance Technologies also initiated a $3.9 million position during the quarter. The other funds with new positions in the stock are D. E. Shaw’s D E Shaw, Peter Muller’s PDT Partners, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s go over hedge fund activity in other stocks similar to Portola Pharmaceuticals Inc (NASDAQ:PTLA). We will take a look at Progress Software Corporation (NASDAQ:PRGS), McGrath RentCorp (NASDAQ:MGRC), O-I Glass, Inc. (NYSE:OI), and Axos Financial, Inc. (NYSE:AX). This group of stocks’ market values resemble PTLA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PRGS | 20 | 222597 | -2 |

| MGRC | 20 | 150034 | -2 |

| OI | 20 | 504837 | -4 |

| AX | 15 | 70849 | 0 |

| Average | 18.75 | 237079 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $237 million. That figure was $222 million in PTLA’s case. Progress Software Corporation (NASDAQ:PRGS) is the most popular stock in this table. On the other hand Axos Financial, Inc. (NYSE:AX) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Portola Pharmaceuticals Inc (NASDAQ:PTLA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th and still beat the market by 4.2 percentage points. Unfortunately PTLA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PTLA were disappointed as the stock returned -70.4% during the three months of 2020 (through April 6th) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.