Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ recent losses in Facebook. Let’s take a closer look at what the funds we track think about Foot Locker, Inc. (NYSE:FL) in this article.

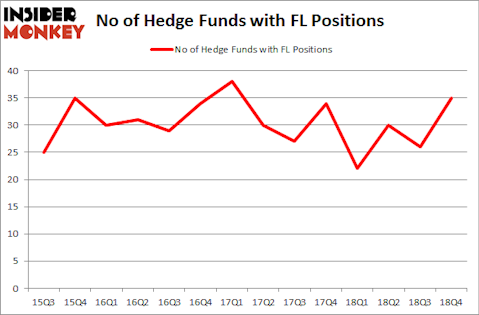

Foot Locker, Inc. (NYSE:FL) was in 35 hedge funds’ portfolios at the end of the fourth quarter of 2018. FL has seen an increase in support from the world’s most elite money managers of late. There were 26 hedge funds in our database with FL positions at the end of the previous quarter. Our calculations also showed that FL isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to review the latest hedge fund action regarding Foot Locker, Inc. (NYSE:FL).

How have hedgies been trading Foot Locker, Inc. (NYSE:FL)?

At Q4’s end, a total of 35 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 35% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards FL over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in Foot Locker, Inc. (NYSE:FL), which was worth $375.3 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $151.9 million worth of shares. Moreover, Interval Partners, Millennium Management, and Renaissance Technologies were also bullish on Foot Locker, Inc. (NYSE:FL), allocating a large percentage of their portfolios to this stock.

Consequently, key money managers have been driving this bullishness. Interval Partners, managed by Gregg Moskowitz, assembled the biggest position in Foot Locker, Inc. (NYSE:FL). Interval Partners had $47.1 million invested in the company at the end of the quarter. Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital also initiated a $14.9 million position during the quarter. The other funds with new positions in the stock are Anthony Joseph Vaccarino’s North Fourth Asset Management, Steven Boyd’s Armistice Capital, and Gregg Moskowitz’s Interval Partners.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Foot Locker, Inc. (NYSE:FL) but similarly valued. We will take a look at Carlisle Companies, Inc. (NYSE:CSL), Pool Corporation (NASDAQ:POOL), Vectren Corporation (NYSE:VVC), and PRA Health Sciences Inc (NASDAQ:PRAH). This group of stocks’ market caps are similar to FL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CSL | 21 | 340572 | -1 |

| POOL | 17 | 242228 | 0 |

| VVC | 23 | 731051 | 4 |

| PRAH | 25 | 297610 | -3 |

| Average | 21.5 | 402865 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $403 million. That figure was $879 million in FL’s case. PRA Health Sciences Inc (NASDAQ:PRAH) is the most popular stock in this table. On the other hand Pool Corporation (NASDAQ:POOL) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Foot Locker, Inc. (NYSE:FL) is more popular among hedge funds. Our calculations showed that the top 15 most popular stocks among hedge funds returned 21.3% year-to-date through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on FL, though not to the same extent, as the stock returned 19.8% and outperformed the market as well.Disclosure: None. This article was originally published at Insider Monkey.