The latest 13F reporting period has come and gone, and Insider Monkey have plowed through 821 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, a week after the market trough. Now, we are almost done with the second quarter. Investors decided to bet on the economic recovery and a stock market rebound. S&P 500 Index returned almost 20% this quarter. In this article you are going to find out whether hedge funds thoughtConocoPhillips (NYSE:COP) was a good investment heading into the second quarter and how the stock traded in comparison to the top hedge fund picks.

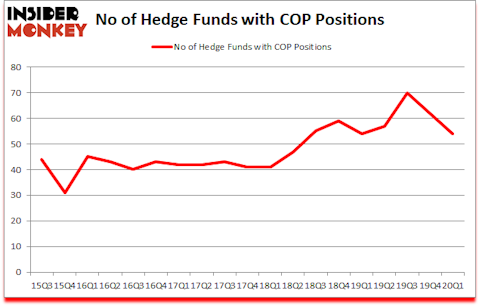

Is ConocoPhillips (NYSE:COP) a buy, sell, or hold? Prominent investors were in a bearish mood. The number of bullish hedge fund positions dropped by 8 in recent months. Our calculations also showed that COP isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). COP was in 54 hedge funds’ portfolios at the end of March. There were 62 hedge funds in our database with COP holdings at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, this trader claims to score lucrative profits by utilizing a “weekend trading strategy”, so we look into his strategy’s picks. Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost gold prices. So, we are checking out this junior gold mining stock. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We recently recommended several stocks partly inspired by legendary Bill Miller’s investor letter. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a look at the key hedge fund action encompassing ConocoPhillips (NYSE:COP).

Hedge fund activity in ConocoPhillips (NYSE:COP)

At the end of the first quarter, a total of 54 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from the previous quarter. On the other hand, there were a total of 54 hedge funds with a bullish position in COP a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, D E Shaw was the largest shareholder of ConocoPhillips (NYSE:COP), with a stake worth $321.9 million reported as of the end of September. Trailing D E Shaw was Fisher Asset Management, which amassed a stake valued at $140.8 million. Adage Capital Management, Point72 Asset Management, and Yacktman Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Elm Ridge Capital allocated the biggest weight to ConocoPhillips (NYSE:COP), around 7.29% of its 13F portfolio. SIR Capital Management is also relatively very bullish on the stock, designating 5.88 percent of its 13F equity portfolio to COP.

Because ConocoPhillips (NYSE:COP) has experienced falling interest from hedge fund managers, logic holds that there lies a certain “tier” of fund managers who sold off their entire stakes by the end of the first quarter. It’s worth mentioning that Matt Smith’s Deep Basin Capital cut the largest stake of the 750 funds followed by Insider Monkey, totaling about $27.2 million in stock. Sara Nainzadeh’s fund, Centenus Global Management, also dropped its stock, about $15 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 8 funds by the end of the first quarter.

Let’s check out hedge fund activity in other stocks similar to ConocoPhillips (NYSE:COP). These stocks are Roper Technologies Inc. (NYSE:ROP), Sempra Energy (NYSE:SRE), Analog Devices, Inc. (NASDAQ:ADI), and Sumitomo Mitsui Financial Grp, Inc. (NYSE:SMFG). This group of stocks’ market valuations are similar to COP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ROP | 38 | 1015909 | -2 |

| SRE | 27 | 505194 | -8 |

| ADI | 45 | 1979695 | -6 |

| SMFG | 10 | 104520 | -1 |

| Average | 30 | 901330 | -4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $901 million. That figure was $962 million in COP’s case. Analog Devices, Inc. (NASDAQ:ADI) is the most popular stock in this table. On the other hand Sumitomo Mitsui Financial Grp, Inc. (NYSE:SMFG) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks ConocoPhillips (NYSE:COP) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 12.3% in 2020 through June 30th but still managed to beat the market by 15.5 percentage points. Hedge funds were also right about betting on COP as the stock returned 37.8% in Q2 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Conocophillips (NYSE:COP)

Follow Conocophillips (NYSE:COP)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.