After several tireless days we have finished crunching the numbers from nearly 900 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of March 31st. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards BioNTech SE (NASDAQ:BNTX).

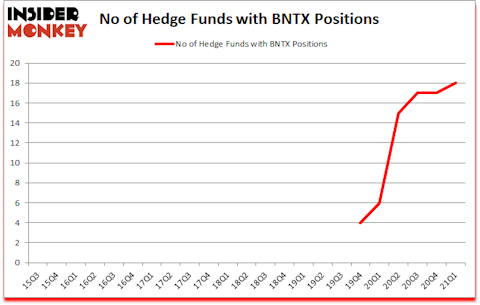

BioNTech SE (NASDAQ:BNTX) has experienced an increase in support from the world’s most elite money managers recently. BioNTech SE (NASDAQ:BNTX) was in 18 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic was previously 17. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that BNTX isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 115 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

Philippe Laffont of Coatue Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, pet market is growing at a 7% annual rate and is expected to reach $110 billion in 2021. So, we are checking out the 5 best stocks for animal lovers. We go through lists like the 15 best Jim Cramer stocks to identify the next Tesla that will deliver outsized returns. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to take a glance at the new hedge fund action surrounding BioNTech SE (NASDAQ:BNTX).

Do Hedge Funds Think BNTX Is A Good Stock To Buy Now?

At the end of March, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from one quarter earlier. On the other hand, there were a total of 6 hedge funds with a bullish position in BNTX a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in BioNTech SE (NASDAQ:BNTX) was held by Citadel Investment Group, which reported holding $77.1 million worth of stock at the end of December. It was followed by Coatue Management with a $37.3 million position. Other investors bullish on the company included Armistice Capital, Platinum Asset Management, and Polar Capital. In terms of the portfolio weights assigned to each position Sivik Global Healthcare allocated the biggest weight to BioNTech SE (NASDAQ:BNTX), around 0.8% of its 13F portfolio. Armistice Capital is also relatively very bullish on the stock, designating 0.69 percent of its 13F equity portfolio to BNTX.

As industrywide interest jumped, key money managers have been driving this bullishness. Coatue Management, managed by Philippe Laffont, assembled the most outsized position in BioNTech SE (NASDAQ:BNTX). Coatue Management had $37.3 million invested in the company at the end of the quarter. Brian Ashford-Russell and Tim Woolley’s Polar Capital also initiated a $24.6 million position during the quarter. The following funds were also among the new BNTX investors: Krishen Sud’s Sivik Global Healthcare, Frank Fu’s CaaS Capital, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as BioNTech SE (NASDAQ:BNTX) but similarly valued. These stocks are XPeng Inc. (NYSE:XPEV), Zebra Technologies Corporation (NASDAQ:ZBRA), Ryanair Holdings plc (NASDAQ:RYAAY), Banco Santander (Brasil) SA (NYSE:BSBR), Hormel Foods Corporation (NYSE:HRL), DTE Energy Company (NYSE:DTE), and Carnival Corporation (NYSE:CCL). All of these stocks’ market caps match BNTX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XPEV | 19 | 976276 | -11 |

| ZBRA | 35 | 1163526 | -6 |

| RYAAY | 14 | 568235 | -9 |

| BSBR | 5 | 3887 | -1 |

| HRL | 26 | 483859 | -5 |

| DTE | 26 | 205605 | -3 |

| CCL | 44 | 593600 | -3 |

| Average | 24.1 | 570713 | -5.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.1 hedge funds with bullish positions and the average amount invested in these stocks was $571 million. That figure was $173 million in BNTX’s case. Carnival Corporation (NYSE:CCL) is the most popular stock in this table. On the other hand Banco Santander (Brasil) SA (NYSE:BSBR) is the least popular one with only 5 bullish hedge fund positions. BioNTech SE (NASDAQ:BNTX) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for BNTX is 52.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.5% in 2021 through July 23rd and still beat the market by 10.1 percentage points. A small number of hedge funds were also right about betting on BNTX as the stock returned 158.2% since the end of the first quarter (through 7/23) and outperformed the market by an even larger margin.

Follow Biontech Se (NASDAQ:BNTX)

Follow Biontech Se (NASDAQ:BNTX)

Receive real-time insider trading and news alerts

Suggested Articles:

- Top 10 Cloud Computing Stocks To Buy

- 10 Best Paper Stocks To Buy Now

- 25 Best Things to Do in NYC During COVID-19

Disclosure: None. This article was originally published at Insider Monkey.