Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN).

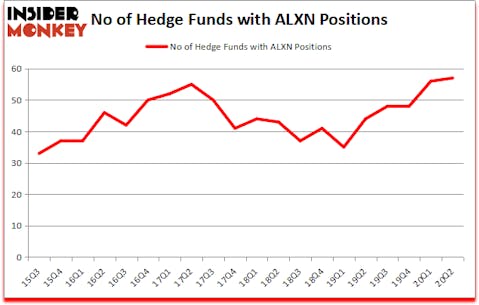

Is Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) ready to rally soon? Prominent investors were turning bullish. The number of bullish hedge fund positions went up by 1 recently. Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) was in 57 hedge funds’ portfolios at the end of June. The all time high for this statistics is 56. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that ALXN isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 56 hedge funds in our database with ALXN holdings at the end of March.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Felix Baker of Baker Bros.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind let’s review the fresh hedge fund action surrounding Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN).

How have hedgies been trading Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN)?

Heading into the third quarter of 2020, a total of 57 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 2% from the first quarter of 2020. On the other hand, there were a total of 44 hedge funds with a bullish position in ALXN a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Baker Bros. Advisors, managed by Julian Baker and Felix Baker, holds the number one position in Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN). Baker Bros. Advisors has a $983.3 million position in the stock, comprising 4.3% of its 13F portfolio. Sitting at the No. 2 spot is Renaissance Technologies, with a $502.8 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions consist of OrbiMed Advisors, Cliff Asness’s AQR Capital Management and David Cohen and Harold Levy’s Iridian Asset Management. In terms of the portfolio weights assigned to each position Copernicus Capital Management allocated the biggest weight to Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN), around 10.46% of its 13F portfolio. Sarissa Capital Management is also relatively very bullish on the stock, earmarking 9.28 percent of its 13F equity portfolio to ALXN.

As one would reasonably expect, some big names have jumped into Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) headfirst. Deerfield Management, managed by James E. Flynn, established the biggest position in Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN). Deerfield Management had $20.9 million invested in the company at the end of the quarter. Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management also initiated a $20.6 million position during the quarter. The other funds with new positions in the stock are Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management, John W. Rende’s Copernicus Capital Management, and Simon Sadler’s Segantii Capital.

Let’s check out hedge fund activity in other stocks similar to Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN). These stocks are Credit Suisse Group AG (NYSE:CS), Nokia Corporation (NYSE:NOK), Zimmer Biomet Holdings Inc (NYSE:ZBH), Rockwell Automation Inc. (NYSE:ROK), Waste Connections, Inc. (NYSE:WCN), Telefonica S.A. (NYSE:TEF), and Otis Worldwide Corporation (NYSE:OTIS). This group of stocks’ market values are similar to ALXN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CS | 14 | 134420 | 3 |

| NOK | 26 | 218711 | 3 |

| ZBH | 62 | 752893 | 11 |

| ROK | 50 | 546946 | 13 |

| WCN | 39 | 720610 | 6 |

| TEF | 6 | 9842 | -1 |

| OTIS | 56 | 2110419 | 52 |

| Average | 36.1 | 641977 | 12.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.1 hedge funds with bullish positions and the average amount invested in these stocks was $642 million. That figure was $3578 million in ALXN’s case. Zimmer Biomet Holdings Inc (NYSE:ZBH) is the most popular stock in this table. On the other hand Telefonica S.A. (NYSE:TEF) is the least popular one with only 6 bullish hedge fund positions. Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for ALXN is 81.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 29.2% in 2020 through October 16th and beat the market by 19.7 percentage points. Unfortunately ALXN wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on ALXN were slightly disappointed as the stock returned 10.6% since the end of June (through 10/16) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Alexion Pharmaceuticals Inc. (NASDAQ:ALXN)

Follow Alexion Pharmaceuticals Inc. (NASDAQ:ALXN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.