The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31st, about a week after the S&P 500 Index bottomed. We at Insider Monkey have made an extensive database of more than 821 of those established hedge funds and famous value investors’ filings. In this article, we analyze how the smart money traded Activision Blizzard, Inc. (NASDAQ:ATVI) based on those filings and determine whether they were smart about it.

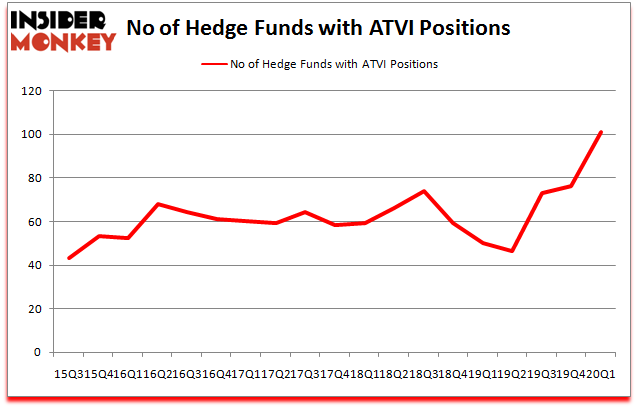

Is Activision Blizzard, Inc. (NASDAQ:ATVI) worth your attention right now? Prominent investors are turning bullish. The number of long hedge fund positions improved by 25 lately and reached its all time high. Our calculations also showed that ATVI ranked 21st among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). ATVI was in 101 hedge funds’ portfolios at the end of March. There were 76 hedge funds in our database with ATVI positions at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 36% through May 18th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. There is a lot of volatility in the markets and this presents amazing investment opportunities from time to time. For example, this trader claims to deliver juiced up returns with one trade a week, so we are checking out his highest conviction idea. A second trader claims to score lucrative profits by utilizing a “weekend trading strategy”, so we look into his strategy’s picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We recently recommended several stocks partly inspired by legendary Bill Miller’s investor letter. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to take a glance at the new hedge fund action surrounding Activision Blizzard, Inc. (NASDAQ:ATVI).

What does smart money think about Activision Blizzard, Inc. (NASDAQ:ATVI)?

At the end of the first quarter, a total of 101 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from the fourth quarter of 2019. On the other hand, there were a total of 50 hedge funds with a bullish position in ATVI a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Citadel Investment Group was the largest shareholder of Activision Blizzard, Inc. (NASDAQ:ATVI), with a stake worth $273.1 million reported as of the end of September. Trailing Citadel Investment Group was Alkeon Capital Management, which amassed a stake valued at $224.1 million. Jericho Capital Asset Management, SoMa Equity Partners, and Suvretta Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Jericho Capital Asset Management allocated the biggest weight to Activision Blizzard, Inc. (NASDAQ:ATVI), around 13.82% of its 13F portfolio. Discovery Capital Management is also relatively very bullish on the stock, setting aside 10.28 percent of its 13F equity portfolio to ATVI.

As one would reasonably expect, key hedge funds have been driving this bullishness. Whale Rock Capital Management, managed by Alex Sacerdote, assembled the most valuable position in Activision Blizzard, Inc. (NASDAQ:ATVI). Whale Rock Capital Management had $117.5 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $95.9 million investment in the stock during the quarter. The following funds were also among the new ATVI investors: Anand Parekh’s Alyeska Investment Group, Dmitry Balyasny’s Balyasny Asset Management, and Renaissance Technologies.

Let’s now review hedge fund activity in other stocks similar to Activision Blizzard, Inc. (NASDAQ:ATVI). We will take a look at Boston Scientific Corporation (NYSE:BSX), Illinois Tool Works Inc. (NYSE:ITW), Ecolab Inc. (NYSE:ECL), and Intercontinental Exchange Inc (NYSE:ICE). This group of stocks’ market valuations are similar to ATVI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BSX | 59 | 3081420 | 5 |

| ITW | 34 | 296563 | 2 |

| ECL | 38 | 1597530 | -6 |

| ICE | 61 | 2491084 | 9 |

| Average | 48 | 1866649 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 48 hedge funds with bullish positions and the average amount invested in these stocks was $1867 million. That figure was $3054 million in ATVI’s case. Intercontinental Exchange Inc (NYSE:ICE) is the most popular stock in this table. On the other hand Illinois Tool Works Inc. (NYSE:ITW) is the least popular one with only 34 bullish hedge fund positions. Compared to these stocks Activision Blizzard, Inc. (NASDAQ:ATVI) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 13.3% in 2020 through June 25th but still managed to beat the market by 16.8 percentage points. Hedge funds were also right about betting on ATVI as the stock returned 29% so far in Q2 (through June 25th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Activision Blizzard Inc. (NASDAQ:ATVI)

Follow Activision Blizzard Inc. (NASDAQ:ATVI)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.