The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 873 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 30th. In this article we look at what those investors think of Microsoft Corporation (NASDAQ:MSFT).

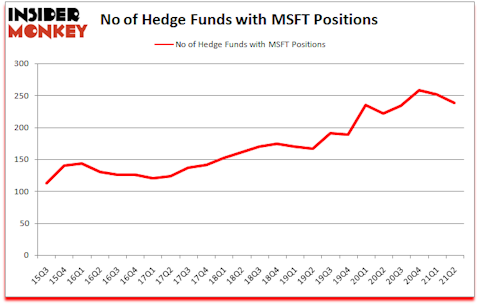

Microsoft Corporation (NASDAQ:MSFT) was in 238 hedge funds’ portfolios at the end of June. The all time high for this statistic is 258. MSFT investors should be aware of a decrease in activity from the world’s largest hedge funds lately. There were 251 hedge funds in our database with MSFT holdings at the end of March. Our calculations also showed that MSFT ranked #3 among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Today there are a large number of indicators market participants use to grade stocks. A pair of the most under-the-radar indicators are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can outclass the broader indices by a solid margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Chris Hohn of TCI Fund Management

With all of this in mind let’s go over the new hedge fund action encompassing Microsoft Corporation (NASDAQ:MSFT).

Do Hedge Funds Think MSFT Is A Good Stock To Buy Now?

At second quarter’s end, a total of 238 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MSFT over the last 24 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Microsoft Corporation (NASDAQ:MSFT) was held by Fisher Asset Management, which reported holding $6721.9 million worth of stock at the end of June. It was followed by TCI Fund Management with a $5549 million position. Other investors bullish on the company included Arrowstreet Capital, Citadel Investment Group, and Tiger Global Management LLC. In terms of the portfolio weights assigned to each position Skye Global Management allocated the biggest weight to Microsoft Corporation (NASDAQ:MSFT), around 30.61% of its 13F portfolio. Joho Capital is also relatively very bullish on the stock, setting aside 28.61 percent of its 13F equity portfolio to MSFT.

Judging by the fact that Microsoft Corporation (NASDAQ:MSFT) has experienced bearish sentiment from the smart money, it’s easy to see that there lies a certain “tier” of money managers that elected to cut their entire stakes last quarter. Interestingly, Masayoshi Son’s SB Management cut the biggest stake of the 750 funds watched by Insider Monkey, totaling about $1030 million in stock, and Eashwar Krishnan’s Tybourne Capital Management was right behind this move, as the fund dumped about $293.5 million worth. These transactions are interesting, as aggregate hedge fund interest was cut by 13 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to Microsoft Corporation (NASDAQ:MSFT). These stocks are Amazon.com, Inc. (NASDAQ:AMZN), Alphabet Inc (NASDAQ:GOOGL), Facebook Inc (NASDAQ:FB), Tesla Inc. (NASDAQ:TSLA), Berkshire Hathaway Inc. (NYSE:BRK-B), Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM), and Alibaba Group Holding Limited (NYSE:BABA). This group of stocks’ market caps match MSFT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMZN | 271 | 60492350 | 28 |

| GOOGL | 190 | 26833902 | 5 |

| FB | 266 | 42349769 | 9 |

| TSLA | 60 | 9296858 | -2 |

| BRK-B | 116 | 22380662 | 5 |

| TSM | 64 | 10694405 | -12 |

| BABA | 146 | 16793500 | 11 |

| Average | 159 | 26977349 | 6.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 159 hedge funds with bullish positions and the average amount invested in these stocks was $26977 million. That figure was $62465 million in MSFT’s case. Amazon.com, Inc. (NASDAQ:AMZN) is the most popular stock in this table. On the other hand Tesla Inc. (NASDAQ:TSLA) is the least popular one with only 60 bullish hedge fund positions. Microsoft Corporation (NASDAQ:MSFT) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for MSFT is 96.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 26.3% in 2021 through October 29th and still beat the market by 2.3 percentage points. Hedge funds were also right about betting on MSFT as the stock returned 22.6% since the end of Q2 (through 10/29) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Microsoft Corp (NASDAQ:MSFT)

Follow Microsoft Corp (NASDAQ:MSFT)

Receive real-time insider trading and news alerts

Suggested Articles:

- Michael Burry is Shorting Tesla and Buying These 10 Stocks Instead

- 10 Best Insurance Stocks To Buy Now

- 10 Best Bank Stocks To Buy Now

Disclosure: None. This article was originally published at Insider Monkey.