We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 835 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about MGE Energy, Inc. (NASDAQ:MGEE).

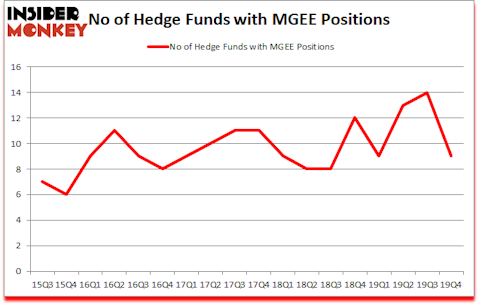

MGE Energy, Inc. (NASDAQ:MGEE) was in 9 hedge funds’ portfolios at the end of December. MGEE shareholders have witnessed a decrease in enthusiasm from smart money recently. There were 14 hedge funds in our database with MGEE holdings at the end of the previous quarter. Our calculations also showed that MGEE isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

To most market participants, hedge funds are viewed as slow, outdated financial vehicles of yesteryear. While there are greater than 8000 funds trading at present, We choose to focus on the elite of this club, around 850 funds. These money managers control most of all hedge funds’ total asset base, and by observing their finest picks, Insider Monkey has figured out a number of investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Keeping this in mind let’s review the new hedge fund action surrounding MGE Energy, Inc. (NASDAQ:MGEE).

What have hedge funds been doing with MGE Energy, Inc. (NASDAQ:MGEE)?

At the end of the fourth quarter, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -36% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MGEE over the last 18 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in MGE Energy, Inc. (NASDAQ:MGEE) was held by Renaissance Technologies, which reported holding $35.2 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $2.1 million position. Other investors bullish on the company included Arrowstreet Capital, Holocene Advisors, and PDT Partners. In terms of the portfolio weights assigned to each position PDT Partners allocated the biggest weight to MGE Energy, Inc. (NASDAQ:MGEE), around 0.06% of its 13F portfolio. Centiva Capital is also relatively very bullish on the stock, designating 0.03 percent of its 13F equity portfolio to MGEE.

Judging by the fact that MGE Energy, Inc. (NASDAQ:MGEE) has faced falling interest from the smart money, it’s easy to see that there exists a select few hedgies who were dropping their entire stakes heading into Q4. Intriguingly, Israel Englander’s Millennium Management dumped the largest position of all the hedgies followed by Insider Monkey, comprising close to $6.8 million in stock. Roger Ibbotson’s fund, Zebra Capital Management, also cut its stock, about $0.8 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 5 funds heading into Q4.

Let’s also examine hedge fund activity in other stocks similar to MGE Energy, Inc. (NASDAQ:MGEE). We will take a look at First Interstate Bancsystem Inc (NASDAQ:FIBK), Advanced Energy Industries, Inc. (NASDAQ:AEIS), Wolverine World Wide, Inc. (NYSE:WWW), and TreeHouse Foods Inc. (NYSE:THS). This group of stocks’ market values resemble MGEE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FIBK | 12 | 58971 | 2 |

| AEIS | 20 | 149266 | 3 |

| WWW | 23 | 119537 | 2 |

| THS | 27 | 237953 | 8 |

| Average | 20.5 | 141432 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $141 million. That figure was $43 million in MGEE’s case. TreeHouse Foods Inc. (NYSE:THS) is the most popular stock in this table. On the other hand First Interstate Bancsystem Inc (NASDAQ:FIBK) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks MGE Energy, Inc. (NASDAQ:MGEE) is even less popular than FIBK. Hedge funds clearly dropped the ball on MGEE as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but still beat the market by 4.2 percentage points. A small number of hedge funds were also right about betting on MGEE as the stock returned -12.4% during the same time period and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.