Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

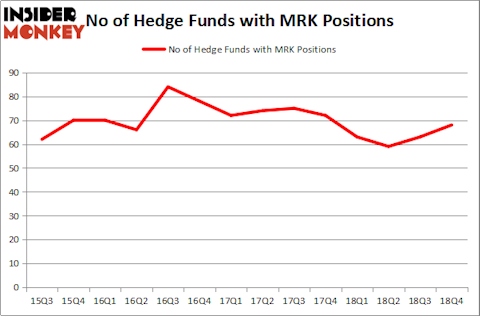

Merck & Co., Inc. (NYSE:MRK) was in 68 hedge funds’ portfolios at the end of December. MRK has seen an increase in support from the world’s most elite money managers in recent months. There were 63 hedge funds in our database with MRK holdings at the end of the previous quarter. Our calculations also showed that MRK isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a gander at the new hedge fund action encompassing Merck & Co., Inc. (NYSE:MRK).

How are hedge funds trading Merck & Co., Inc. (NYSE:MRK)?

At Q4’s end, a total of 68 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in MRK over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in Merck & Co., Inc. (NYSE:MRK), which was worth $999.3 million at the end of the third quarter. On the second spot was Fisher Asset Management which amassed $643.9 million worth of shares. Moreover, Arrowstreet Capital, Adage Capital Management, and D E Shaw were also bullish on Merck & Co., Inc. (NYSE:MRK), allocating a large percentage of their portfolios to this stock.

Consequently, key money managers have been driving this bullishness. Hudson Bay Capital Management, managed by Sander Gerber, created the most outsized call position in Merck & Co., Inc. (NYSE:MRK). Hudson Bay Capital Management had $76.4 million invested in the company at the end of the quarter. Pasco Alfaro / Richard Tumure’s Miura Global Management also initiated a $32.5 million position during the quarter. The following funds were also among the new MRK investors: Ian Simm’s Impax Asset Management, Ernest Chow and Jonathan Howe’s Sensato Capital Management, and Nick Niell’s Arrowgrass Capital Partners.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Merck & Co., Inc. (NYSE:MRK) but similarly valued. We will take a look at Novartis AG (NYSE:NVS), China Mobile Limited (NYSE:CHL), Cisco Systems, Inc. (NASDAQ:CSCO), and The Home Depot, Inc. (NYSE:HD). This group of stocks’ market values resemble MRK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NVS | 34 | 1826780 | 5 |

| CHL | 14 | 450334 | -1 |

| CSCO | 55 | 3238755 | -3 |

| HD | 58 | 3964549 | 1 |

| Average | 40.25 | 2370105 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40.25 hedge funds with bullish positions and the average amount invested in these stocks was $2370 million. That figure was $5196 million in MRK’s case. The Home Depot, Inc. (NYSE:HD) is the most popular stock in this table. On the other hand China Mobile Limited (NYSE:CHL) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Merck & Co., Inc. (NYSE:MRK) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately MRK wasn’t in this group. Hedge funds that bet on MRK were disappointed as the stock returned 7.5% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.