In this article you are going to find out whether hedge funds think Guardant Health, Inc. (NASDAQ:GH) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

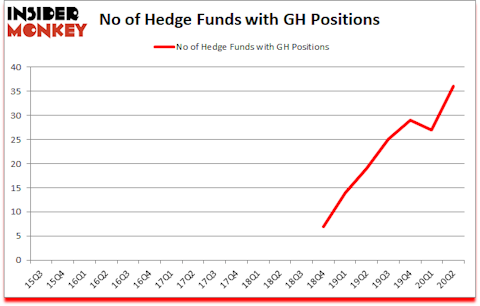

Guardant Health, Inc. (NASDAQ:GH) shareholders have witnessed an increase in support from the world’s most elite money managers in recent months. Guardant Health, Inc. (NASDAQ:GH) was in 36 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 29. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 27 hedge funds in our database with GH positions at the end of the first quarter. Our calculations also showed that GH isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are dozens of metrics stock market investors have at their disposal to value their holdings. Two of the most underrated metrics are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the top money managers can outperform the S&P 500 by a very impressive amount (see the details here).

Philippe Laffont of Coatue Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind we’re going to check out the key hedge fund action regarding Guardant Health, Inc. (NASDAQ:GH).

What does smart money think about Guardant Health, Inc. (NASDAQ:GH)?

At Q2’s end, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from one quarter earlier. On the other hand, there were a total of 19 hedge funds with a bullish position in GH a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Viking Global, managed by Andreas Halvorsen, holds the most valuable position in Guardant Health, Inc. (NASDAQ:GH). Viking Global has a $248.9 million position in the stock, comprising 1.1% of its 13F portfolio. Sitting at the No. 2 spot is Philippe Laffont of Coatue Management, with a $127.8 million position; 1.1% of its 13F portfolio is allocated to the stock. Some other professional money managers with similar optimism contain Paul Marshall and Ian Wace’s Marshall Wace LLP, Arthur B Cohen and Joseph Healey’s Healthcor Management LP and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Iron Triangle Partners allocated the biggest weight to Guardant Health, Inc. (NASDAQ:GH), around 3.38% of its 13F portfolio. Healthcor Management LP is also relatively very bullish on the stock, earmarking 2.44 percent of its 13F equity portfolio to GH.

With a general bullishness amongst the heavyweights, specific money managers have jumped into Guardant Health, Inc. (NASDAQ:GH) headfirst. Healthcor Management LP, managed by Arthur B Cohen and Joseph Healey, established the most outsized position in Guardant Health, Inc. (NASDAQ:GH). Healthcor Management LP had $58.3 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $26.2 million position during the quarter. The following funds were also among the new GH investors: Jeremy Green’s Redmile Group, Renaissance Technologies, and Peter Muller’s PDT Partners.

Let’s also examine hedge fund activity in other stocks similar to Guardant Health, Inc. (NASDAQ:GH). We will take a look at Graco Inc. (NYSE:GGG), LKQ Corporation (NASDAQ:LKQ), Entegris Inc (NASDAQ:ENTG), NRG Energy Inc (NYSE:NRG), Globe Life Inc. (NYSE:GL), Universal Health Services, Inc. (NYSE:UHS), and Paylocity Holding Corp (NASDAQ:PCTY). All of these stocks’ market caps are similar to GH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GGG | 32 | 204789 | 11 |

| LKQ | 44 | 1536917 | 3 |

| ENTG | 28 | 601485 | 9 |

| NRG | 36 | 1095466 | -2 |

| GL | 33 | 706101 | 11 |

| UHS | 38 | 446238 | 8 |

| PCTY | 24 | 476733 | -9 |

| Average | 33.6 | 723961 | 4.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.6 hedge funds with bullish positions and the average amount invested in these stocks was $724 million. That figure was $768 million in GH’s case. LKQ Corporation (NASDAQ:LKQ) is the most popular stock in this table. On the other hand Paylocity Holding Corp (NASDAQ:PCTY) is the least popular one with only 24 bullish hedge fund positions. Guardant Health, Inc. (NASDAQ:GH) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for GH is 70. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Hedge funds were also right about betting on GH as the stock returned 31.5% since the end of Q2 (through 10/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Guardant Health Inc. (NASDAQ:GH)

Follow Guardant Health Inc. (NASDAQ:GH)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.