Is Kansas City Southern (NYSE:KSU) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

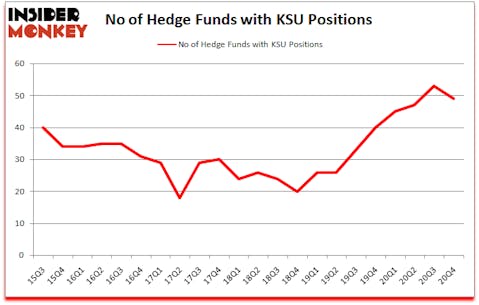

Kansas City Southern (NYSE:KSU) has seen a decrease in hedge fund sentiment in recent months. Kansas City Southern (NYSE:KSU) was in 49 hedge funds’ portfolios at the end of December. The all time high for this statistic is 53. Our calculations also showed that KSU isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

If you’d ask most traders, hedge funds are viewed as slow, old investment vehicles of years past. While there are over 8000 funds with their doors open today, Our experts hone in on the bigwigs of this club, approximately 850 funds. These hedge fund managers preside over most of all hedge funds’ total capital, and by tracking their finest investments, Insider Monkey has determined various investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 197% since March 2017 (through March 2021) and beat the S&P 500 Index by 124 percentage points. You can download a sample issue of this newsletter on our website .

Minhua Zhang of Weld Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s check out the fresh hedge fund action regarding Kansas City Southern (NYSE:KSU).

Do Hedge Funds Think KSU Is A Good Stock To Buy Now?

At the end of the fourth quarter, a total of 49 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -8% from one quarter earlier. By comparison, 40 hedge funds held shares or bullish call options in KSU a year ago. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Ken Griffin’s Citadel Investment Group has the number one position in Kansas City Southern (NYSE:KSU), worth close to $183.5 million, amounting to less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is Richard Chilton of Chilton Investment Company, with a $138.7 million position; the fund has 4% of its 13F portfolio invested in the stock. Remaining peers that are bullish contain Ken Fisher’s Fisher Asset Management, Farallon Capital and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Mountain Road Advisors allocated the biggest weight to Kansas City Southern (NYSE:KSU), around 6.53% of its 13F portfolio. Marlowe Partners is also relatively very bullish on the stock, dishing out 4.74 percent of its 13F equity portfolio to KSU.

Seeing as Kansas City Southern (NYSE:KSU) has experienced falling interest from the smart money, we can see that there exists a select few hedgies who sold off their entire stakes last quarter. Intriguingly, Robert Bishop’s Impala Asset Management dropped the biggest investment of the “upper crust” of funds tracked by Insider Monkey, worth about $73 million in stock, and Carl Tiedemann and Michael Tiedemann’s TIG Advisors was right behind this move, as the fund cut about $42.9 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 4 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Kansas City Southern (NYSE:KSU). We will take a look at Fortis Inc. (NYSE:FTS), Incyte Corporation (NASDAQ:INCY), Vipshop Holdings Limited (NYSE:VIPS), ORIX Corporation (NYSE:IX), Ingersoll Rand Inc. (NYSE:IR), Qorvo Inc (NASDAQ:QRVO), and TransUnion (NYSE:TRU). All of these stocks’ market caps are closest to KSU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FTS | 9 | 206819 | 1 |

| INCY | 37 | 3891495 | 2 |

| VIPS | 27 | 524692 | 3 |

| IX | 3 | 4453 | -1 |

| IR | 34 | 939520 | 8 |

| QRVO | 51 | 2122157 | 0 |

| TRU | 41 | 2025227 | -6 |

| Average | 28.9 | 1387766 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.9 hedge funds with bullish positions and the average amount invested in these stocks was $1388 million. That figure was $1021 million in KSU’s case. Qorvo Inc (NASDAQ:QRVO) is the most popular stock in this table. On the other hand ORIX Corporation (NYSE:IX) is the least popular one with only 3 bullish hedge fund positions. Kansas City Southern (NYSE:KSU) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for KSU is 76.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 90.7% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 35 percentage points. These stocks gained 13.6% in 2021 through April 30th and still beat the market by 1.6 percentage points. Hedge funds were also right about betting on KSU as the stock returned 43.5% since the end of Q4 (through 4/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Kansas City Southern (NYSE:KSU)

Follow Kansas City Southern (NYSE:KSU)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.