We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind, let’s take a look at whether Intercontinental Exchange Inc (NYSE:ICE) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

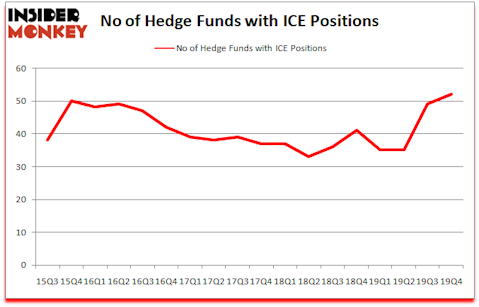

Is Intercontinental Exchange Inc (NYSE:ICE) a buy right now? Money managers are buying. The number of long hedge fund bets moved up by 3 in recent months. Our calculations also showed that ICE isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In the financial world there are a lot of methods stock market investors have at their disposal to analyze stocks. A couple of the less utilized methods are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the best investment managers can outpace their index-focused peers by a superb margin (see the details here).

William Von Mueffling of Cantillon Capital Management

With all of this in mind we’re going to review the fresh hedge fund action encompassing Intercontinental Exchange Inc (NYSE:ICE).

How have hedgies been trading Intercontinental Exchange Inc (NYSE:ICE)?

At Q4’s end, a total of 52 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the third quarter of 2019. Below, you can check out the change in hedge fund sentiment towards ICE over the last 18 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

The largest stake in Intercontinental Exchange Inc (NYSE:ICE) was held by Cantillon Capital Management, which reported holding $410.8 million worth of stock at the end of September. It was followed by GQG Partners with a $369.6 million position. Other investors bullish on the company included D E Shaw, Alkeon Capital Management, and Iridian Asset Management. In terms of the portfolio weights assigned to each position Truvvo Partners allocated the biggest weight to Intercontinental Exchange Inc (NYSE:ICE), around 18.28% of its 13F portfolio. Crescent Park Management is also relatively very bullish on the stock, dishing out 5.15 percent of its 13F equity portfolio to ICE.

Now, specific money managers have jumped into Intercontinental Exchange Inc (NYSE:ICE) headfirst. Interval Partners, managed by Gregg Moskowitz, initiated the biggest position in Intercontinental Exchange Inc (NYSE:ICE). Interval Partners had $4.8 million invested in the company at the end of the quarter. Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors also made a $4.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Paul Tudor Jones’s Tudor Investment Corp, Ian Simm’s Impax Asset Management, and Philippe Laffont’s Coatue Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Intercontinental Exchange Inc (NYSE:ICE) but similarly valued. We will take a look at JD.Com Inc (NASDAQ:JD), ABB Ltd (NYSE:ABB), General Dynamics Corporation (NYSE:GD), and Sumitomo Mitsui Financial Grp, Inc. (NYSE:SMFG). This group of stocks’ market caps are closest to ICE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JD | 63 | 6041314 | 3 |

| ABB | 10 | 372334 | -3 |

| GD | 46 | 6699253 | 4 |

| SMFG | 11 | 584035 | 0 |

| Average | 32.5 | 3424234 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.5 hedge funds with bullish positions and the average amount invested in these stocks was $3424 million. That figure was $2713 million in ICE’s case. JD.Com Inc (NASDAQ:JD) is the most popular stock in this table. On the other hand ABB Ltd (NYSE:ABB) is the least popular one with only 10 bullish hedge fund positions. Intercontinental Exchange Inc (NYSE:ICE) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but still beat the market by 12.9 percentage points. Hedge funds were also right about betting on ICE, though not to the same extent, as the stock returned -3.8% during the first four months of 2020 (through May 1st) and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.