Will the new coronavirus cause a recession in US in the next 6 months? On February 27th, we put the probability at 75% and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Intel Corporation (NASDAQ:INTC).

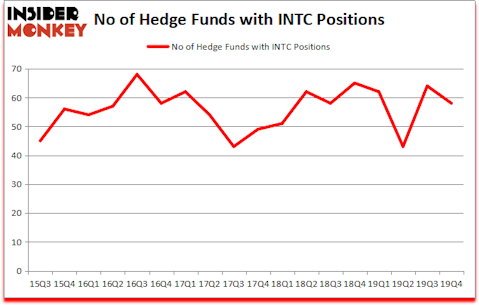

Is Intel Corporation (NASDAQ:INTC) a worthy stock to buy now? Investors who are in the know are in a pessimistic mood. The number of bullish hedge fund bets retreated by 6 in recent months. Our calculations also showed that INTC isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

At the moment there are numerous metrics stock traders put to use to size up their stock investments. A couple of the less known metrics are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the best investment managers can outperform the market by a significant amount (see the details here).

Michael Platt of BlueCrest Capital Mgmt.

We leave no stone unturned when looking for the next great investment idea. For example, this trader is claiming triple digit returns, so we check out his latest trade recommendations. Federal Reserve and Central Banks all around world are printing money like there is no tomorrow, so we check out this this precious metals expert’s stock pick. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s take a gander at the recent hedge fund action surrounding Intel Corporation (NASDAQ:INTC).

What have hedge funds been doing with Intel Corporation (NASDAQ:INTC)?

At the end of the fourth quarter, a total of 58 of the hedge funds tracked by Insider Monkey were long this stock, a change of -9% from the previous quarter. By comparison, 65 hedge funds held shares or bullish call options in INTC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ken Fisher’s Fisher Asset Management has the most valuable position in Intel Corporation (NASDAQ:INTC), worth close to $1.616 billion, comprising 1.6% of its total 13F portfolio. Coming in second is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $1.1357 billion position; 2.6% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors with similar optimism contain Cliff Asness’s AQR Capital Management, and Noam Gottesman’s GLG Partners. In terms of the portfolio weights assigned to each position MFP Investors allocated the biggest weight to Intel Corporation (NASDAQ:INTC), around 16.9% of its 13F portfolio. Platinum Asset Management is also relatively very bullish on the stock, designating 5.49 percent of its 13F equity portfolio to INTC.

Because Intel Corporation (NASDAQ:INTC) has witnessed falling interest from the smart money, it’s easy to see that there were a few money managers who sold off their entire stakes heading into Q4. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP dropped the biggest stake of all the hedgies monitored by Insider Monkey, totaling close to $19.3 million in stock. Ray Dalio’s fund, Bridgewater Associates, also said goodbye to its stock, about $11.1 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 6 funds heading into Q4.

Let’s now review hedge fund activity in other stocks similar to Intel Corporation (NASDAQ:INTC). We will take a look at Verizon Communications Inc. (NYSE:VZ), The Home Depot, Inc. (NYSE:HD), The Coca-Cola Company (NYSE:KO), and Merck & Co., Inc. (NYSE:MRK). This group of stocks’ market valuations are similar to INTC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VZ | 65 | 1885232 | 1 |

| HD | 91 | 4996321 | 21 |

| KO | 51 | 23797078 | -5 |

| MRK | 77 | 5164143 | -3 |

| Average | 71 | 8960694 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 71 hedge funds with bullish positions and the average amount invested in these stocks was $8961 million. That figure was $6147 million in INTC’s case. The Home Depot, Inc. (NYSE:HD) is the most popular stock in this table. On the other hand The Coca-Cola Company (NYSE:KO) is the least popular one with only 51 bullish hedge fund positions. Intel Corporation (NASDAQ:INTC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 1.0% in 2020 through April 20th but still beat the market by 11 percentage points. A small number of hedge funds were also right about betting on INTC as the stock returned -0.6% during the same time period and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.