Will the new coronavirus cause a recession in US in the next 6 months? On February 27th, we put the probability at 75% and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards IAC/InterActiveCorp (NASDAQ:IAC).

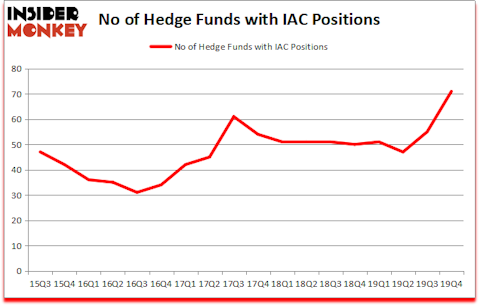

Is IAC/InterActiveCorp (NASDAQ:IAC) a good stock to buy now? Hedge funds are betting on the stock. The number of bullish hedge fund bets inched up by 16 lately. Our calculations also showed that IAC isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings). IAC was in 71 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 55 hedge funds in our database with IAC holdings at the end of the previous quarter.

In the 21st century investor’s toolkit there are plenty of metrics stock traders use to assess their stock investments. Some of the less known metrics are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the best fund managers can trounce the S&P 500 by a superb amount (see the details here).

Christian Leone of Luxor Capital Group

We leave no stone unturned when looking for the next great investment idea. For example, this trader is claiming triple digit returns, so we check out his latest trade recommendations. Federal Reserve and Central Banks all around world are printing money like there is no tomorrow, so we check out this this precious metals expert’s stock pick. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s view the new hedge fund action encompassing IAC/InterActiveCorp (NASDAQ:IAC).

How are hedge funds trading IAC/InterActiveCorp (NASDAQ:IAC)?

Heading into the first quarter of 2020, a total of 71 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 29% from the previous quarter. By comparison, 50 hedge funds held shares or bullish call options in IAC a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

Among these funds, Farallon Capital held the most valuable stake in IAC/InterActiveCorp (NASDAQ:IAC), which was worth $514.8 million at the end of the third quarter. On the second spot was Aristeia Capital which amassed $387.9 million worth of shares. Cadian Capital, Luxor Capital Group, and Ursa Fund Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position AREX Capital Management allocated the biggest weight to IAC/InterActiveCorp (NASDAQ:IAC), around 37.35% of its 13F portfolio. Aristeia Capital is also relatively very bullish on the stock, designating 25.63 percent of its 13F equity portfolio to IAC.

As aggregate interest increased, key hedge funds were breaking ground themselves. Ursa Fund Management, managed by Andrew Hahn, initiated the biggest position in IAC/InterActiveCorp (NASDAQ:IAC). Ursa Fund Management had $292.2 million invested in the company at the end of the quarter. Lone Pine Capital also made a $99.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Michel Massoud’s Melqart Asset Management, Andrew Rechtschaffen’s AREX Capital Management, and Michael Kahan and Jeremy Kahan’s North Peak Capital.

Let’s go over hedge fund activity in other stocks similar to IAC/InterActiveCorp (NASDAQ:IAC). These stocks are Smith & Nephew plc (NYSE:SNN), Synopsys, Inc. (NASDAQ:SNPS), Veeva Systems Inc (NYSE:VEEV), and Brown-Forman Corporation (NYSE:BF). This group of stocks’ market caps are similar to IAC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SNN | 3 | 131490 | -3 |

| SNPS | 45 | 1164571 | 0 |

| VEEV | 44 | 766454 | 8 |

| BF | 23 | 609563 | 1 |

| Average | 28.75 | 668020 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.75 hedge funds with bullish positions and the average amount invested in these stocks was $668 million. That figure was $3319 million in IAC’s case. Synopsys, Inc. (NASDAQ:SNPS) is the most popular stock in this table. On the other hand Smith & Nephew plc (NYSE:SNN) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks IAC/InterActiveCorp (NASDAQ:IAC) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 1.0% in 2020 through April 20th but still managed to beat the market by 11 percentage points. Hedge funds were also right about betting on IAC, though not to the same extent, as the stock returned -10% in 2020 (through April 20th) and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.