Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. At Insider Monkey, we pore over the filings of nearly 835 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of December 31. In this article, we will use that wealth of knowledge to determine whether or not Heartland Express, Inc. (NASDAQ:HTLD) makes for a good investment right now.

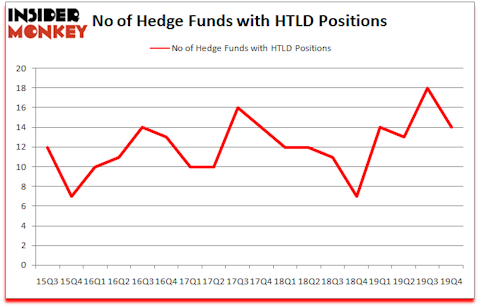

Is Heartland Express, Inc. (NASDAQ:HTLD) a buy, sell, or hold? The best stock pickers are reducing their bets on the stock. The number of bullish hedge fund bets shrunk by 4 recently. Our calculations also showed that HTLD isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings). HTLD was in 14 hedge funds’ portfolios at the end of December. There were 18 hedge funds in our database with HTLD positions at the end of the previous quarter.

In the 21st century investor’s toolkit there are plenty of metrics stock traders employ to size up their stock investments. Two of the less known metrics are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the best fund managers can beat the S&P 500 by a very impressive margin (see the details here).

Noam Gottesman of GLG Partners

We leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve and other Central Banks are tripping over each other to print more money. As a result, we believe gold stocks will outperform fixed income ETFs in the long-term. So we are checking out investment opportunities like this one. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to take a look at the key hedge fund action regarding Heartland Express, Inc. (NASDAQ:HTLD).

Hedge fund activity in Heartland Express, Inc. (NASDAQ:HTLD)

At the end of the fourth quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -22% from the previous quarter. By comparison, 7 hedge funds held shares or bullish call options in HTLD a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Renaissance Technologies, holds the most valuable position in Heartland Express, Inc. (NASDAQ:HTLD). Renaissance Technologies has a $13.6 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is Noam Gottesman of GLG Partners, with a $1.9 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining members of the smart money that are bullish include D. E. Shaw’s D E Shaw, John Overdeck and David Siegel’s Two Sigma Advisors and Brandon Haley’s Holocene Advisors. In terms of the portfolio weights assigned to each position Southport Management allocated the biggest weight to Heartland Express, Inc. (NASDAQ:HTLD), around 1.42% of its 13F portfolio. AlphaCrest Capital Management is also relatively very bullish on the stock, setting aside 0.05 percent of its 13F equity portfolio to HTLD.

Due to the fact that Heartland Express, Inc. (NASDAQ:HTLD) has witnessed bearish sentiment from hedge fund managers, logic holds that there were a few fund managers who were dropping their entire stakes last quarter. It’s worth mentioning that Richard Driehaus’s Driehaus Capital cut the biggest stake of the 750 funds followed by Insider Monkey, valued at close to $5.5 million in stock, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital was right behind this move, as the fund dumped about $4.1 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 4 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Heartland Express, Inc. (NASDAQ:HTLD) but similarly valued. We will take a look at Merit Medical Systems, Inc. (NASDAQ:MMSI), ICF International Inc (NASDAQ:ICFI), BRP Inc. (NASDAQ:DOOO), and Hecla Mining Company (NYSE:HL). This group of stocks’ market caps resemble HTLD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MMSI | 17 | 80551 | 0 |

| ICFI | 11 | 29456 | 0 |

| DOOO | 9 | 126097 | -1 |

| HL | 14 | 78944 | 4 |

| Average | 12.75 | 78762 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $79 million. That figure was $23 million in HTLD’s case. Merit Medical Systems, Inc. (NASDAQ:MMSI) is the most popular stock in this table. On the other hand BRP Inc. (NASDAQ:DOOO) is the least popular one with only 9 bullish hedge fund positions. Heartland Express, Inc. (NASDAQ:HTLD) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but still beat the market by 4.2 percentage points. Hedge funds were also right about betting on HTLD as the stock returned -9.7% in 2020 (through April 6th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.