Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

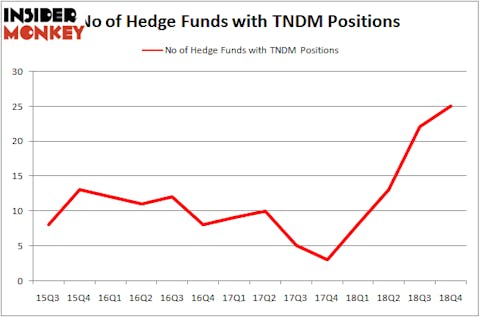

Tandem Diabetes Care Inc (NASDAQ:TNDM) has seen an increase in hedge fund interest lately. TNDM was in 25 hedge funds’ portfolios at the end of December. There were 22 hedge funds in our database with TNDM positions at the end of the previous quarter. Our calculations also showed that TNDM isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are perceived as unimportant, old financial tools of the past. While there are more than 8000 funds in operation today, We hone in on the top tier of this club, approximately 750 funds. It is estimated that this group of investors administer bulk of all hedge funds’ total capital, and by paying attention to their top equity investments, Insider Monkey has come up with numerous investment strategies that have historically exceeded the market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a peek at the latest hedge fund action encompassing Tandem Diabetes Care Inc (NASDAQ:TNDM).

What does the smart money think about Tandem Diabetes Care Inc (NASDAQ:TNDM)?

At the end of the fourth quarter, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from one quarter earlier. On the other hand, there were a total of 8 hedge funds with a bullish position in TNDM a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the largest position in Tandem Diabetes Care Inc (NASDAQ:TNDM). Renaissance Technologies has a $53.6 million position in the stock, comprising 0.1% of its 13F portfolio. Coming in second is Steve Cohen of Point72 Asset Management, with a $45.8 million position; 0.2% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that are bullish encompass Jeremy Green’s Redmile Group, Samuel Isaly’s OrbiMed Advisors and Principal Global Investors’s Columbus Circle Investors.

Consequently, specific money managers have been driving this bullishness. AQR Capital Management, managed by Cliff Asness, established the most valuable position in Tandem Diabetes Care Inc (NASDAQ:TNDM). AQR Capital Management had $20.5 million invested in the company at the end of the quarter. Mariko Gordon’s Daruma Asset Management also made a $18.9 million investment in the stock during the quarter. The following funds were also among the new TNDM investors: Josh Goldberg’s G2 Investment Partners Management, Joel Greenblatt’s Gotham Asset Management, and D. E. Shaw’s D E Shaw.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Tandem Diabetes Care Inc (NASDAQ:TNDM) but similarly valued. These stocks are Washington Federal Inc. (NASDAQ:WAFD), Eventbrite, Inc. (NYSE:EB), Beacon Roofing Supply, Inc. (NASDAQ:BECN), and ProAssurance Corporation (NYSE:PRA). This group of stocks’ market caps resemble TNDM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WAFD | 12 | 76775 | -1 |

| EB | 8 | 415314 | -12 |

| BECN | 21 | 356118 | 0 |

| PRA | 13 | 172578 | 0 |

| Average | 13.5 | 255196 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $255 million. That figure was $374 million in TNDM’s case. Beacon Roofing Supply, Inc. (NASDAQ:BECN) is the most popular stock in this table. On the other hand Eventbrite, Inc. (NYSE:EB) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Tandem Diabetes Care Inc (NASDAQ:TNDM) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on TNDM as the stock returned 49.5% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.