Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 5 months of this year through May 30th the Standard and Poor’s 500 Index returned approximately 12.1% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like SINA Corp (NASDAQ:SINA).

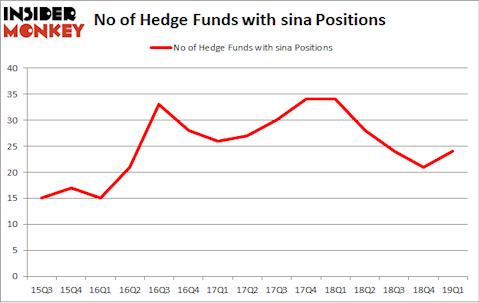

SINA Corp (NASDAQ:SINA) investors should be aware of an increase in hedge fund sentiment recently. Our calculations also showed that sina isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a peek at the recent hedge fund action encompassing SINA Corp (NASDAQ:SINA).

Hedge fund activity in SINA Corp (NASDAQ:SINA)

At Q1’s end, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from the previous quarter. By comparison, 34 hedge funds held shares or bullish call options in SINA a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in SINA Corp (NASDAQ:SINA) was held by Platinum Asset Management, which reported holding $106.9 million worth of stock at the end of March. It was followed by D E Shaw with a $82.4 million position. Other investors bullish on the company included Tairen Capital, HBK Investments, and GLG Partners.

As industrywide interest jumped, specific money managers were breaking ground themselves. GLG Partners, managed by Noam Gottesman, established the biggest position in SINA Corp (NASDAQ:SINA). GLG Partners had $41.8 million invested in the company at the end of the quarter. Thomas Steyer’s Farallon Capital also initiated a $38.5 million position during the quarter. The other funds with new positions in the stock are Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, Benjamin A. Smith’s Laurion Capital Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to SINA Corp (NASDAQ:SINA). These stocks are Amneal Pharmaceuticals, Inc. (NYSE:AMRX), Brighthouse Financial, Inc. (NASDAQ:BHF), Marriott Vacations Worldwide Corporation (NYSE:VAC), and J2 Global Inc (NASDAQ:JCOM). All of these stocks’ market caps are closest to SINA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMRX | 8 | 27694 | 0 |

| BHF | 31 | 378363 | 7 |

| VAC | 26 | 399866 | 0 |

| JCOM | 22 | 264086 | 5 |

| Average | 21.75 | 267502 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $268 million. That figure was $475 million in SINA’s case. Brighthouse Financial, Inc. (NASDAQ:BHF) is the most popular stock in this table. On the other hand Amneal Pharmaceuticals, Inc. (NYSE:AMRX) is the least popular one with only 8 bullish hedge fund positions. SINA Corp (NASDAQ:SINA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately SINA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SINA were disappointed as the stock returned -31% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.