At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

Silgan Holdings Inc. (NASDAQ:SLGN) has experienced an increase in hedge fund interest lately. Our calculations also showed that slgn isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are assumed to be unimportant, old financial tools of the past. While there are over 8000 funds with their doors open at the moment, We hone in on the aristocrats of this club, around 750 funds. These money managers command the lion’s share of the smart money’s total asset base, and by tracking their first-class picks, Insider Monkey has uncovered a few investment strategies that have historically beaten the market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a peek at the latest hedge fund action encompassing Silgan Holdings Inc. (NASDAQ:SLGN).

How are hedge funds trading Silgan Holdings Inc. (NASDAQ:SLGN)?

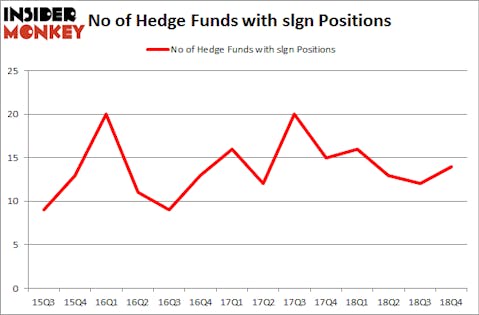

At Q4’s end, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 17% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards SLGN over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Cardinal Capital was the largest shareholder of Silgan Holdings Inc. (NASDAQ:SLGN), with a stake worth $71.6 million reported as of the end of September. Trailing Cardinal Capital was Winton Capital Management, which amassed a stake valued at $16.1 million. D E Shaw, GLG Partners, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, specific money managers have jumped into Silgan Holdings Inc. (NASDAQ:SLGN) headfirst. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the biggest position in Silgan Holdings Inc. (NASDAQ:SLGN). Arrowstreet Capital had $2.1 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $0.5 million investment in the stock during the quarter. The following funds were also among the new SLGN investors: D. E. Shaw’s D E Shaw and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Silgan Holdings Inc. (NASDAQ:SLGN) but similarly valued. These stocks are BancorpSouth Bank (NYSE:BXS), Vishay Intertechnology, Inc. (NYSE:VSH), Smartsheet Inc. (NYSE:SMAR), and Cabot Corporation (NYSE:CBT). This group of stocks’ market caps match SLGN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BXS | 9 | 54741 | 2 |

| VSH | 19 | 333325 | -3 |

| SMAR | 17 | 186129 | 6 |

| CBT | 29 | 124001 | 5 |

| Average | 18.5 | 174549 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $175 million. That figure was $108 million in SLGN’s case. Cabot Corporation (NYSE:CBT) is the most popular stock in this table. On the other hand BancorpSouth Bank (NYSE:BXS) is the least popular one with only 9 bullish hedge fund positions. Silgan Holdings Inc. (NASDAQ:SLGN) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on SLGN as the stock returned 27.5% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.