We at Insider Monkey have gone over 738 13F filings that hedge funds and famous value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article we look at what those investors think of Service Corporation International (NYSE:SCI).

Service Corporation International (NYSE:SCI) investors should pay attention to an increase in activity from the world’s largest hedge funds of late. Our calculations also showed that SCI isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are plenty of gauges shareholders can use to appraise publicly traded companies. A couple of the less utilized gauges are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the best money managers can trounce the broader indices by a very impressive margin (see the details here).

Glenn Russell Dubin of Highbridge Capital

Let’s take a look at the key hedge fund action encompassing Service Corporation International (NYSE:SCI).

What have hedge funds been doing with Service Corporation International (NYSE:SCI)?

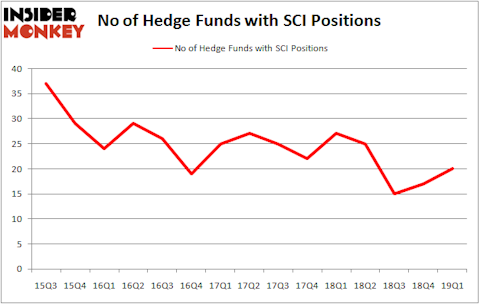

Heading into the second quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18% from one quarter earlier. On the other hand, there were a total of 27 hedge funds with a bullish position in SCI a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Service Corporation International (NYSE:SCI) was held by Select Equity Group, which reported holding $375.1 million worth of stock at the end of March. It was followed by Laurion Capital Management with a $40.2 million position. Other investors bullish on the company included Renaissance Technologies, AQR Capital Management, and Two Sigma Advisors.

Now, some big names were breaking ground themselves. Laurion Capital Management, managed by Benjamin A. Smith, created the biggest position in Service Corporation International (NYSE:SCI). Laurion Capital Management had $40.2 million invested in the company at the end of the quarter. Joseph Samuels’s Islet Management also made a $5 million investment in the stock during the quarter. The other funds with new positions in the stock are Ken Griffin’s Citadel Investment Group, Glenn Russell Dubin’s Highbridge Capital Management, and Jeffrey Talpins’s Element Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Service Corporation International (NYSE:SCI) but similarly valued. These stocks are Xerox Corporation (NYSE:XRX), Ares Capital Corporation (NASDAQ:ARCC), News Corp (NASDAQ:NWS), and The Toro Company (NYSE:TTC). This group of stocks’ market caps resemble SCI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XRX | 33 | 1378808 | -11 |

| ARCC | 22 | 261488 | -4 |

| NWS | 10 | 36380 | -3 |

| TTC | 16 | 577386 | -5 |

| Average | 20.25 | 563516 | -5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $564 million. That figure was $528 million in SCI’s case. Xerox Corporation (NYSE:XRX) is the most popular stock in this table. On the other hand News Corp (NASDAQ:NWS) is the least popular one with only 10 bullish hedge fund positions. Service Corporation International (NYSE:SCI) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on SCI as the stock returned 8.4% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.