Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index returned approximately 13.1% in the first 2.5 months of this year (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. An average long/short hedge fund returned only 5% due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Seaspan Corporation (NYSE:SSW).

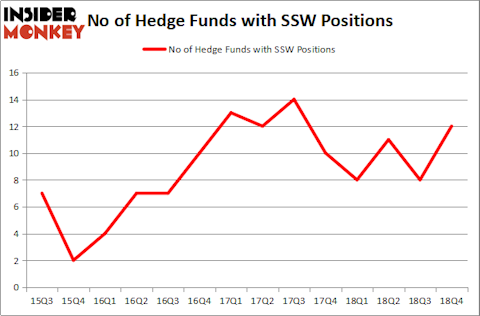

Is Seaspan Corporation (NYSE:SSW) the right pick for your portfolio? Money managers are becoming more confident. The number of bullish hedge fund bets increased by 4 lately. Our calculations also showed that SSW isn’t among the 30 most popular stocks among hedge funds. SSW was in 12 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 8 hedge funds in our database with SSW holdings at the end of the previous quarter.

In the eyes of most market participants, hedge funds are seen as slow, old investment tools of years past. While there are greater than 8000 funds in operation at the moment, Our experts choose to focus on the top tier of this group, approximately 750 funds. It is estimated that this group of investors control the majority of the smart money’s total capital, and by paying attention to their best stock picks, Insider Monkey has come up with several investment strategies that have historically beaten the market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a gander at the new hedge fund action encompassing Seaspan Corporation (NYSE:SSW).

How are hedge funds trading Seaspan Corporation (NYSE:SSW)?

At Q4’s end, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 50% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in SSW over the last 14 quarters. With hedgies’ capital changing hands, there exists a few notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Prem Watsa’s Fairfax Financial Holdings has the largest position in Seaspan Corporation (NYSE:SSW), worth close to $302.6 million, accounting for 16.9% of its total 13F portfolio. On Fairfax Financial Holdings’s heels is Brahman Capital, managed by Mitch Kuflik and Rob Sobel, which holds a $20.6 million position; 1.2% of its 13F portfolio is allocated to the company. Some other peers that hold long positions include Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Jim Simons’s Renaissance Technologies and John Overdeck and David Siegel’s Two Sigma Advisors.

As industrywide interest jumped, specific money managers have jumped into Seaspan Corporation (NYSE:SSW) headfirst. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the most valuable position in Seaspan Corporation (NYSE:SSW). Arrowstreet Capital had $6.8 million invested in the company at the end of the quarter. Louis Navellier’s Navellier & Associates also initiated a $0.6 million position during the quarter. The following funds were also among the new SSW investors: Israel Englander’s Millennium Management, Matthew Tewksbury’s Stevens Capital Management, and Jeffrey Talpins’s Element Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Seaspan Corporation (NYSE:SSW) but similarly valued. These stocks are Rush Enterprises, Inc. (NASDAQ:RUSHB), Magellan Health Inc (NASDAQ:MGLN), SecureWorks Corp. (NASDAQ:SCWX), and Mirati Therapeutics, Inc. (NASDAQ:MRTX). All of these stocks’ market caps are closest to SSW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RUSHB | 3 | 31783 | -2 |

| MGLN | 15 | 299824 | -5 |

| SCWX | 9 | 35899 | 1 |

| MRTX | 27 | 609808 | 3 |

| Average | 13.5 | 244329 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $244 million. That figure was $336 million in SSW’s case. Mirati Therapeutics, Inc. (NASDAQ:MRTX) is the most popular stock in this table. On the other hand Rush Enterprises, Inc. (NASDAQ:RUSHB) is the least popular one with only 3 bullish hedge fund positions. Seaspan Corporation (NYSE:SSW) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on SSW as the stock returned 30.5% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.