Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The fourth quarter of 2018 is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Outfront Media Inc (NYSE:OUT).

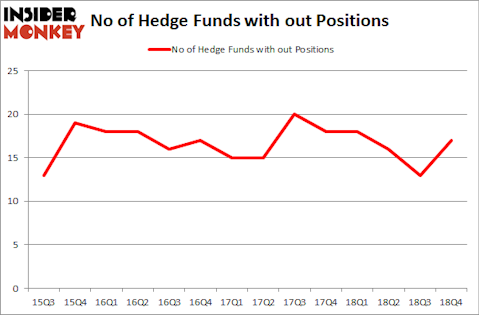

Is Outfront Media Inc (NYSE:OUT) a superb investment now? The smart money is taking a bullish view. The number of long hedge fund bets moved up by 4 recently. Our calculations also showed that out isn’t among the 30 most popular stocks among hedge funds. OUT was in 17 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 13 hedge funds in our database with OUT holdings at the end of the previous quarter.

In today’s marketplace there are several methods stock market investors have at their disposal to grade stocks. A duo of the less utilized methods are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can outpace the market by a very impressive amount (see the details here).

We’re going to take a look at the fresh hedge fund action surrounding Outfront Media Inc (NYSE:OUT).

How have hedgies been trading Outfront Media Inc (NYSE:OUT)?

At the end of the fourth quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 31% from the second quarter of 2018. On the other hand, there were a total of 18 hedge funds with a bullish position in OUT a year ago. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Greg Poole’s Echo Street Capital Management has the number one position in Outfront Media Inc (NYSE:OUT), worth close to $46.8 million, comprising 1.2% of its total 13F portfolio. The second most bullish fund manager is Point72 Asset Management, managed by Steve Cohen, which holds a $36.6 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Remaining peers that are bullish include Israel Englander’s Millennium Management, Jim Simons’s Renaissance Technologies and Dmitry Balyasny’s Balyasny Asset Management.

As one would reasonably expect, key hedge funds were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the biggest position in Outfront Media Inc (NYSE:OUT). Arrowstreet Capital had $3 million invested in the company at the end of the quarter. Dennis Leibowitz’s Act II Capital also initiated a $0.5 million position during the quarter. The following funds were also among the new OUT investors: Richard Driehaus’s Driehaus Capital, David Costen Haley’s HBK Investments, and Mike Vranos’s Ellington.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Outfront Media Inc (NYSE:OUT) but similarly valued. We will take a look at Balchem Corporation (NASDAQ:BCPC), American Equity Investment Life Holding Company (NYSE:AEL), Floor & Decor Holdings, Inc. (NYSE:FND), and Univar Inc (NYSE:UNVR). This group of stocks’ market caps resemble OUT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BCPC | 11 | 57081 | 3 |

| AEL | 17 | 112145 | 4 |

| FND | 19 | 213377 | -6 |

| UNVR | 23 | 701477 | -10 |

| Average | 17.5 | 271020 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $271 million. That figure was $234 million in OUT’s case. Univar Inc (NYSE:UNVR) is the most popular stock in this table. On the other hand Balchem Corporation (NASDAQ:BCPC) is the least popular one with only 11 bullish hedge fund positions. Outfront Media Inc (NYSE:OUT) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on OUT as the stock returned 30.6% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.