The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider Nexstar Media Group, Inc. (NASDAQ:NXST) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

Nexstar Media Group, Inc. (NASDAQ:NXST) has seen a decrease in activity from the world’s largest hedge funds lately. Our calculations also showed that NXST isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a look at the recent hedge fund action surrounding Nexstar Media Group, Inc. (NASDAQ:NXST).

How are hedge funds trading Nexstar Media Group, Inc. (NASDAQ:NXST)?

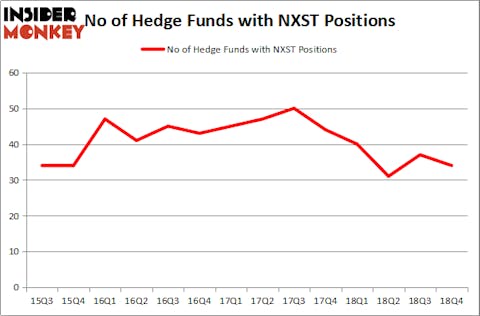

Heading into the first quarter of 2019, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -8% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in NXST over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Snehal Amin’s Windacre Partnership has the most valuable position in Nexstar Media Group, Inc. (NASDAQ:NXST), worth close to $198.6 million, corresponding to 11.4% of its total 13F portfolio. The second most bullish fund manager is Hound Partners, managed by Jonathan Auerbach, which holds a $178.3 million position; 5.7% of its 13F portfolio is allocated to the company. Remaining professional money managers that are bullish encompass Claus Moller’s P2 Capital Partners, Parag Vora’s HG Vora Capital Management and Peter S. Park’s Park West Asset Management.

Seeing as Nexstar Media Group, Inc. (NASDAQ:NXST) has faced a decline in interest from the smart money, we can see that there lies a certain “tier” of hedgies that slashed their full holdings by the end of the third quarter. It’s worth mentioning that Joshua Kaufman and Craig Nerenberg’s Brenner West Capital Partners dropped the largest position of the 700 funds monitored by Insider Monkey, worth an estimated $39.1 million in stock, and Alexander Mitchell’s Scopus Asset Management was right behind this move, as the fund dropped about $25.9 million worth. These transactions are interesting, as total hedge fund interest was cut by 3 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Nexstar Media Group, Inc. (NASDAQ:NXST) but similarly valued. These stocks are The Wendy’s Company (NASDAQ:WEN), MSA Safety Incorporated (NYSE:MSA), SLM Corp (NASDAQ:SLM), and Vipshop Holdings Limited (NYSE:VIPS). This group of stocks’ market valuations are closest to NXST’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WEN | 26 | 964697 | -1 |

| MSA | 17 | 78793 | 7 |

| SLM | 24 | 492797 | 5 |

| VIPS | 22 | 120976 | 0 |

| Average | 22.25 | 414316 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $414 million. That figure was $975 million in NXST’s case. The Wendy’s Company (NASDAQ:WEN) is the most popular stock in this table. On the other hand MSA Safety Incorporated (NYSE:MSA) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Nexstar Media Group, Inc. (NASDAQ:NXST) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on NXST as the stock returned 45.5% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.