A market correction in the fourth quarter, spurred by a number of global macroeconomic concerns and rising interest rates ended up having a negative impact on the markets and many hedge funds as a result. The stocks of smaller companies were especially hard hit during this time as investors fled to investments seen as being safer. This is evident in the fact that the Russell 2000 ETF underperformed the S&P 500 ETF by nearly 7 percentage points during the fourth quarter. We also received indications that hedge funds were trimming their positions amid the market volatility and uncertainty, and given their greater inclination towards smaller cap stocks than other investors, it follows that a stronger sell-off occurred in those stocks. Let’s study the hedge fund sentiment to see how those concerns affected their ownership of JELD-WEN Holding, Inc. (NYSE:JELD) during the quarter.

Is JELD-WEN Holding, Inc. (NYSE:JELD) a good investment today? The smart money is becoming more confident. The number of bullish hedge fund bets inched up by 3 lately. Our calculations also showed that JELD isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the latest hedge fund action regarding JELD-WEN Holding, Inc. (NYSE:JELD).

Hedge fund activity in JELD-WEN Holding, Inc. (NYSE:JELD)

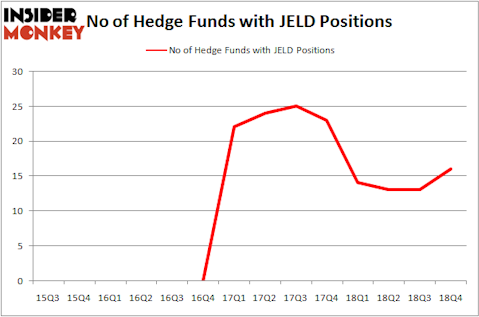

At the end of the fourth quarter, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 23% from the second quarter of 2018. By comparison, 14 hedge funds held shares or bullish call options in JELD a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in JELD-WEN Holding, Inc. (NYSE:JELD) was held by Pzena Investment Management, which reported holding $118.6 million worth of stock at the end of December. It was followed by Hound Partners with a $102 million position. Other investors bullish on the company included Southpoint Capital Advisors, Raging Capital Management, and Roystone Capital Partners.

As one would reasonably expect, key hedge funds have jumped into JELD-WEN Holding, Inc. (NYSE:JELD) headfirst. Two Sigma Advisors, managed by John Overdeck and David Siegel, established the biggest position in JELD-WEN Holding, Inc. (NYSE:JELD). Two Sigma Advisors had $1.2 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also made a $0.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Glenn Russell Dubin’s Highbridge Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks similar to JELD-WEN Holding, Inc. (NYSE:JELD). These stocks are MicroStrategy Incorporated (NASDAQ:MSTR), Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS), Benefitfocus Inc (NASDAQ:BNFT), and The Children’s Place Inc. (NASDAQ:PLCE). This group of stocks’ market caps resemble JELD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MSTR | 23 | 141808 | -2 |

| KTOS | 12 | 99253 | -1 |

| BNFT | 15 | 68806 | 3 |

| PLCE | 19 | 169423 | -4 |

| Average | 17.25 | 119823 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $120 million. That figure was $292 million in JELD’s case. MicroStrategy Incorporated (NASDAQ:MSTR) is the most popular stock in this table. On the other hand Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS) is the least popular one with only 12 bullish hedge fund positions. JELD-WEN Holding, Inc. (NYSE:JELD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on JELD as the stock returned 39.5% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.